Stay ahead of exemptions by automating privacy operations and risk management.

Financial Services

Automate privacy. Build resilience and trust.

As regulations tighten and AI expands data use, automation helps financial services leaders scale privacy, reduce risk, and unlock responsible growth.

Gain resilience

Build customer trust

Deliver compliant, user-friendly privacy experiences that drive data trust.

Innovate responsibly

Extend privacy operations to govern AI models, data, and use cases.

Deliver a compliant privacy experience

Transparency and trust start on your websites and mobile apps. OneTrust helps you deliver a privacy-first user experience that gives your consumers control over their data, enables you to comply with privacy laws, and optimizes opt-in rates.

KEY CAPABILITIES

Manage consent on your websites and mobile apps

Automate Data Subject Request (DSR) fulfillment

Create, maintain, and publish privacy notices

Scale privacy operations and risk management

Identifying, documenting, and assessing how your organization processes personal data is the core of a privacy program. It demonstrates accountability to regulators, creates your acceptable use policy for personal data, and streamlines other privacy operations such as fulfilling DSRs and investigating incidents. OneTrust provides the automation you need — from natively integrated data discovery to regulatory intelligence and the latest AI capabilities.

KEY CAPABILITIES

Build an evergreen data and activity map

Perform privacy risk assessments and mitigation

Assess vendor risk and manage DPAs and data transfers

Manage privacy incidents and notification

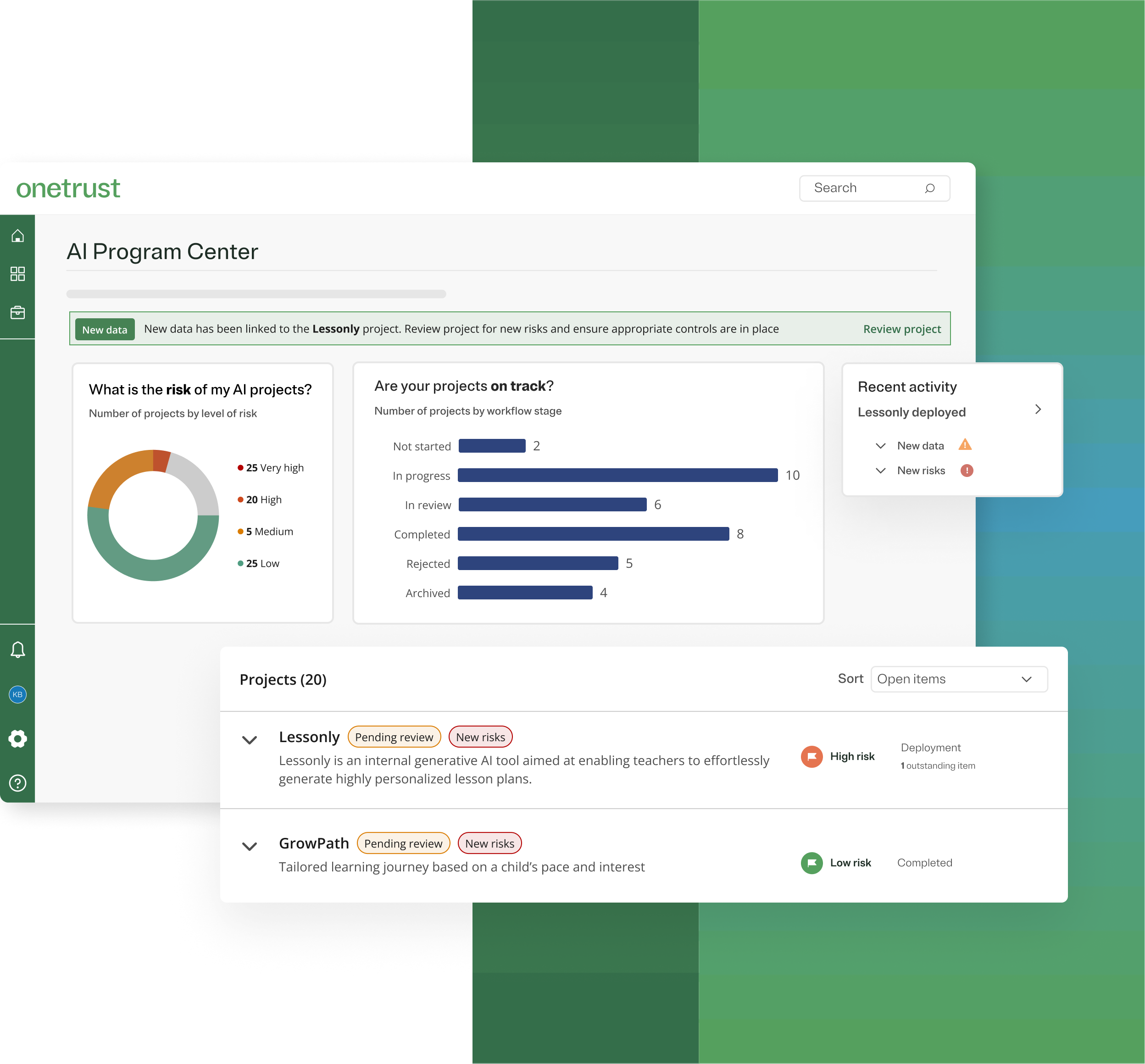

Govern AI and data initiatives

Within financial services organizations, the most valuable data and AI initiatives are built on customer data. OneTrust’s extensible data model helps you use privacy operations as a springboard for AI governance.

KEY CAPABILITIES

Catalog AI systems, models, data sets, and use cases

Automate governance checks across the AI lifecycle

Create AI artifacts like model cards and transparency reports

Programmatically enforce governance policies through data-level controls based on consent, classification, and purpose

Proven results

“We believe that taking responsibility for what we do with personal data not only results in better legal compliance, but also offers the business a competitive edge.”

Mike Dronfield, CISO, Vanquis Banking Group

75% productivity boost

Automated workflows allowed privacy teams to accomplish more with fewer resources.

2024 Forrester Consulting Total Economic Impact™ study

"Consumers expect control over their personal data, especially in financial services where sensitivity is high. Meeting these expectations not only reduces risk but also strengthens customer trust and loyalty."

Manoj Thareja, Leader of Privacy Tech and DSPM, KPMG

You may also like

On-demand webinars

Consent & Preferences

Fueling customer loyalty in banking: Deloitte Digital x OneTrust

Join experts from OneTrust and Deloitte Digital to explore how banks and financial services organizations are embedding consent controls into the customer journey to deliver tailored, high-impact digital experiences

September 04, 2025

Demo

Privacy Automation

Privacy Automation demo

Automate DSR fulfillment, track regulations, maintain an evergreen data map, and so much more — all in one powerful privacy solution.

eBook

Consent & Preferences

Building trust in the AI age: A guide to consent, privacy, and first-party data excellence

Learn how to build trust in the AI era with consent-first, privacy-focused strategies that maximize first-party data and ensure compliance.

August 12, 2025

FAQ

Financial services firms are covered by federal laws like the Gramm-Leach-Bliley Act (GLBA), but also face global and state privacy regulations. These laws expand consumer rights around data access, consent, and transparency, requiring firms to modernize privacy operations.

GLBA primarily governs financial data but does not provide broader protections such as consumer data rights, AI governance, or cross-border transfer requirements. As state privacy laws close gaps left by federal rules, relying on GLBA alone puts firms at compliance and reputational risk.

Automation helps firms manage privacy workflows across consent, Data Subject Requests (DSRs), vendor risk assessments, and incident response. By using an integrated platform, financial institutions can reduce manual effort, improve accuracy, and demonstrate accountability to regulators.

Without automation, firms face higher regulatory fines, reputational damage, and increased customer churn. Manual processes also slow down AI adoption and create friction in delivering seamless digital services.

Transparent consent experiences, clear privacy notices, and timely responses to customer requests demonstrate respect for personal data. This builds stronger customer relationships and positions the institution as a trusted steward of data.

AI governance requires cataloging models and datasets, running governance checks, and creating transparency artifacts like model cards and reports. Extending privacy frameworks to the AI lifecycle helps financial institutions innovate quickly while ensuring responsible and compliant use of customer data.

Request a financial services demo

Interested in seeing how we can help you scale privacy, reduce risk, and unlock responsible growth? Complete the form, and an expert will reach out.