Third-Party Risk Management

Automate your third-party risk management program

Streamline every stage of your third-party lifecycle – from onboarding and assessment to reporting and monitoring.

- Build your customized third-party inventory

- Automate vendor assessments with the control framework of your choice

- Continuously monitor third-party risk and trigger reassessments

Automate third-party risk assessments

Streamline your third-party risk assessment process with out-of-the-box templates or build custom assessments that only ask relevant questions depending on how the third-party answers.

Reduce reputational risk and build trusted relationships

Reduce potential risk with out-of-the-box mitigation recommendations and workflows. Choose from more than 50 built-in control frameworks or import your own. Act faster with rules-based triggers to kick off workflows and auto-assign risks to the right owners.

Listen for real-time third-party changes and set automated rules to trigger actions and send notifications when new risks or vulnerabilities are detected. Choose from dozens of integrations to automate workflows and share information across systems.

Mitigate regulatory compliance risk with automated recordkeeping and powerful reporting. Build customized dashboards based on user role and preferences to surface critical, contextually relevant metrics. Conveniently export brandable PDF reports to review third-party risk management performance with executives or key stakeholders.

Customer testimonial

Vendor risk management is an ongoing initiative that requires buy-in from almost all employees, so we sought to implement a solution where processes are clearly laid out and self-explanatory.

Related products

Third-Party Due Diligence

Elevate your compliance program with third-party due diligence software that helps you ensure that your entire value and supply chain aligns with company values.

Third-Party Risk Exchange

Use our third-party risk exchange to access thousands of pre-completed, industry-standard vendor risk assessments to prioritize vendor relationships.

Privacy Operations

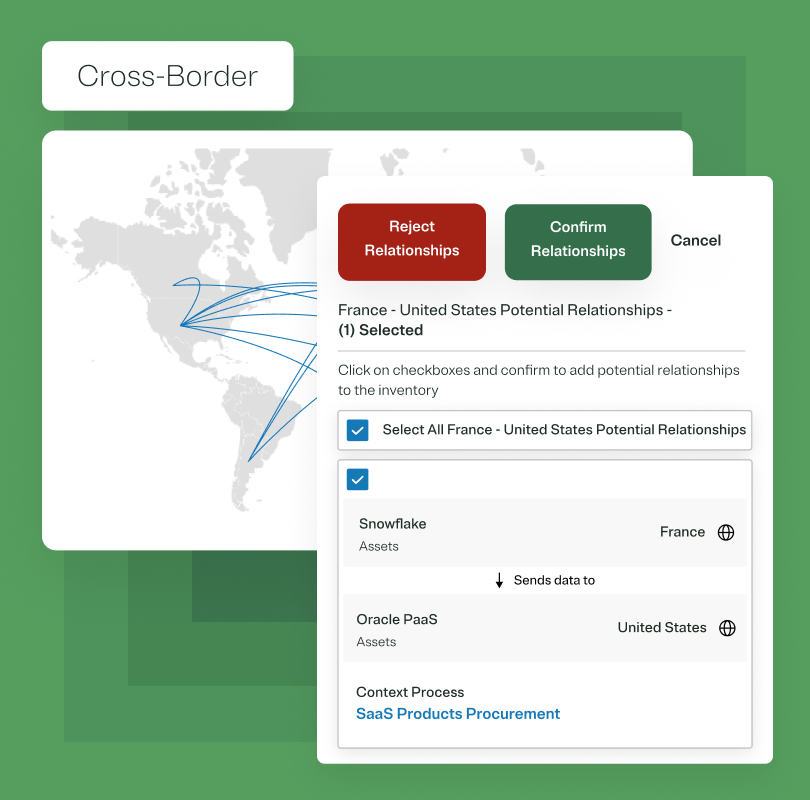

Streamline compliance with data privacy laws and minimize privacy risk by operationalizing your data privacy program.