The idea of a trust transformation has been gathering steam in the last few years. The global pandemic ushered in a “new normal,” forever altering how we work, play, learn, and shop. Constantly connected Generations Y and Z have grown up, unafraid to speak their minds and act for justice. At the same time, the climate crisis is heating up to become the defining issue of our time. Against this backdrop, investors, employees, customers, and other stakeholders are calling for businesses to make good on their commitments to address systemic issues and positively impact people and planet. It’s no longer enough to disburse a token annual grant to a local charity. These stakeholders expect corporate responsibility to be integrated, connected, and transparent throughout the business. To help organizations adapt to this rapidly evolving paradigm shift, we are launching a new ESG 101 blog series. In this first installment, we focus on defining ESG and sustainability: what are ESG topics, why they’re important, and how to map the three pillars of a sustainable business to the Sustainable Development Goals (SDGs) and include them in your ESG strategy. Subsequent articles will dive into each ESG pillar, look at the SDG ESG metrics mappings, and how to incorporate them into your ESG program.

What is ESG and sustainability?

Sustainability is interconnected with society

Sustainability is often assumed to be limited to environmental issues, but it is fundamentally interconnected with economic and societal issues. For example, human activity for economic growth has accelerated climate change, while the climate crisis disproportionately affects women and other marginalized groups. The most widely quoted definition of sustainability is in the 1987 Brundtland Commission Report: “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” At its most basic level, it means:

- Meeting all people’s needs equitably and fairly.

- While operating within the limits of the world’s resources and ecosystems.

- And preserving sufficient resources for future generations to meet their needs.

There is more than one bottom line: people, planet, and profit

In 1994, British management consultant John Elkington applied this concept to business by adding “people” and “planet” to the traditional bottom line of “profit.” This triple bottom line (TBL) was intended to strengthen corporate alignment to and transparency around the true cost of doing business. For example, a chemical company may be profitable but is poisoning nearby rivers and land, causing illness, death, and a decline in natural and human resources. By both the Brundtland and TBL definitions, this company should not be considered successful or profitable, and stakeholders other than shareholders are paying the price: namely the government, local communities, employees, and more. As a result, these stakeholders have become increasingly vocal about and advocating for the need for greater corporate transparency and accountability across the TBL.

From shareholder to stakeholder capitalism

Business leaders started paying attention. In 2020, at the annual meeting of the World Economic Forum (WEF), 120 of the world’s largest companies came together to support development of a common set of ESG disclosure standards and metrics for their stakeholders. These “Stakeholder Capitalism Metrics” were to be based on existing standards for greater comparability and provide a way for companies to track their contributions to the sustainable development goals (SDGs) on a consistent basis.

Stakeholder capitalism is “a form of capitalism in which companies do not only optimize short-term profits for shareholders, but seek long term value creation, by taking into account the needs of all their stakeholders, and society at large.” – WEF

ESG meaning for business: What are the three pillars of a sustainable business?

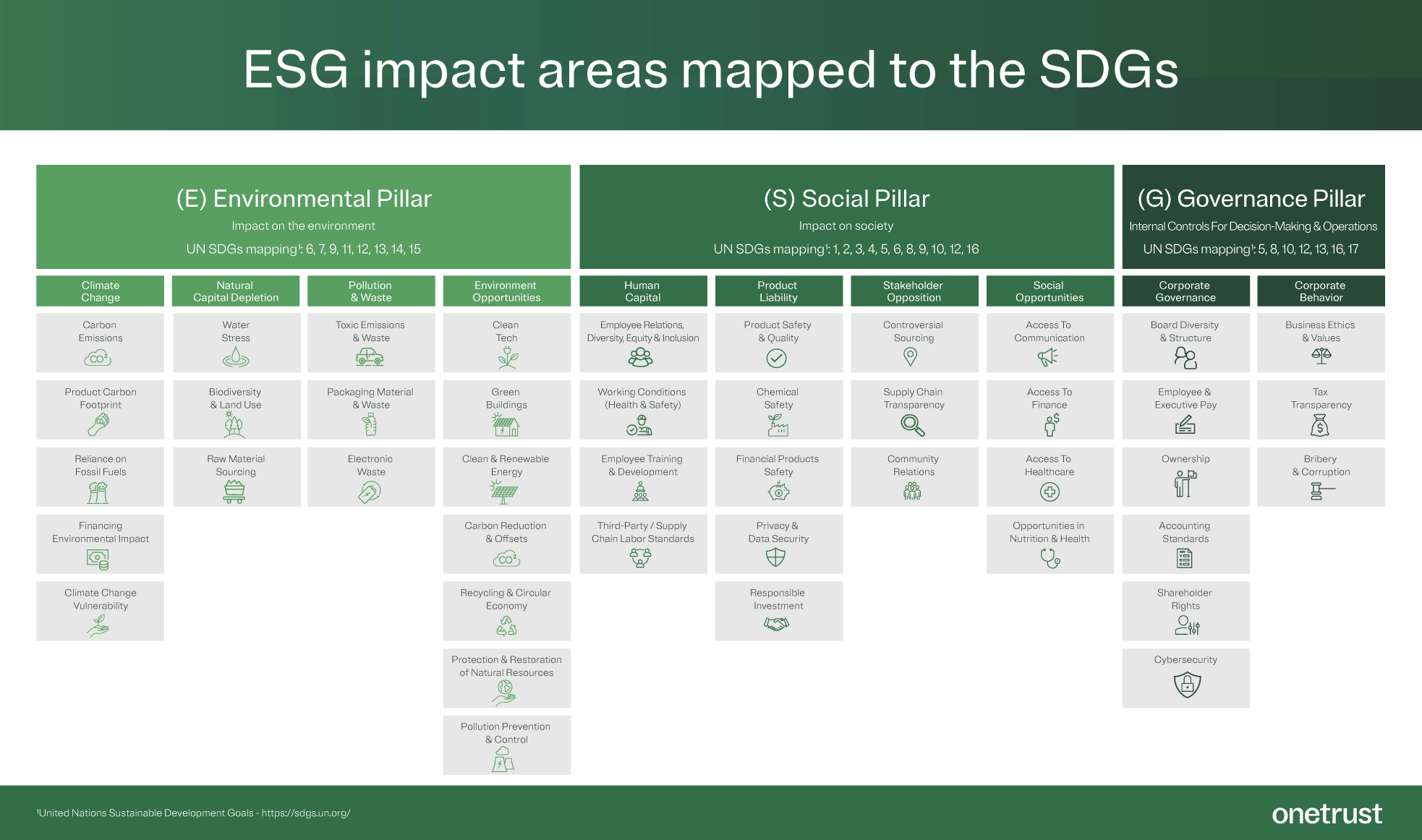

Over time, this has translated into accounting methodologies and frameworks that can help all stakeholders understand and evaluate the behavior of companies from an ethical and sustainable point of view. In this context, ESG stands for environmental, social, and governance, and it denotes the three topic areas that organizations typically report on to their stakeholders:

- Environmental: What is the impact of business operations on the natural world? How are environmental risks and compliance addressed?

- Social: What is the impact of business operations on society? How are stakeholder needs and interests met?

- Governance: How are internal controls for decision-making and business operations structured? How is ethical, sustainable, transparent behavior governed, measured, and reported on?

These topics, or ESG metrics, are also important to investors as they represent inherent risk and opportunity for long-term value creation: several studies have pointed to a tangible link between ESG and financial performance and 81% of sustainable indices are outperforming their peer benchmarks. In fact, the modern ESG model was created as a way for socially conscious investors to screen potential investments. Investors consider ESG factors – and their associated metrics and benchmarks – to be non-financial performance indicators for future valuation.

Who are ESG stakeholders and how are they driving ESG metrics?

ESG stakeholders include anyone with a direct or indirect interest in a business and its impact on people and the planet. And each of these stakeholder groups is driving and shaping how organizations are implementing and reporting on ESG programs.

- Investors use ESG criteria and ratings to target investment into ethical and sustainable assets. Interest in ESG investing has soared in recent years – according to Bloomberg, it could reach $50 trillion by 2025.

- Raters and score providers such as “Most Sustainable…,” “Most Ethical…,” Sustainalytics, MSCI, ISS, etc. are spotlighting purpose-driven companies that are ESG leaders.

- Nonprofits and NGOs are at the forefront of driving ESG regulations, standards, and reporting frameworks. Examples include IFRS, CDP, SASB, GRI, and more.

- Governments around the world are introducing new ESG regulations to protect human rights and the environment: for example, new due diligence and ESG disclosure requirements in Germany, US, UK, Canada, and more. The EU is further along than other regions and has several including GDPR, Directive on Corporate Sustainability Due Diligence, EU Taxonomy, CSRD and ESRS, SFDR, etc.

- Customers prefer to purchase from ethical brands. 74% believe that ethical corporate practices and values are an important reason to choose a brand, and 66% plan to make more sustainable or ethical purchases over the next six months. 67% of consumers also support carbon-labeling on products.

- Businesses use vendor ESG ratings/scores to find ethical and sustainable partners and suppliers.

- Employees want to work for ethical and sustainable companies. 93% believe that companies must lead with purpose, and 65% believe organizations should be responsible for leaving their people “net better off” through work. Employees who strongly agree their organization makes a positive impact on people and the planet are also 3.1x more likely to be extremely satisfied with their organization as a place to work.

- Businesses directly impact the communities in which they operate, so corporate philanthropy often focuses on giving back to local communities. In 2021, nearly 6 in 10 companies reported an increase in community investments over the past three years. Employees are also demanding it: 70% of employees expect opportunities for social impact, and 72% of job seekers are more willing to apply for a job at an organization they consider to be socially responsible.

What are ESG reporting frameworks and standards?

Various ESG reporting frameworks and standards have evolved to meet the needs of different stakeholders and industries including CDP, SASB, GRI, TCFD, (WEF) Stakeholder Capitalism Metrics, and more. While they are not (yet) mandatory, they represent best practices that can help organizations meet stakeholder requirements and comply with emerging regulations around the world.

How to include ESG topics and the UN SDGs in your ESG strategy

What does SDG stand for? How can companies integrate SDGs into their ESG strategy?

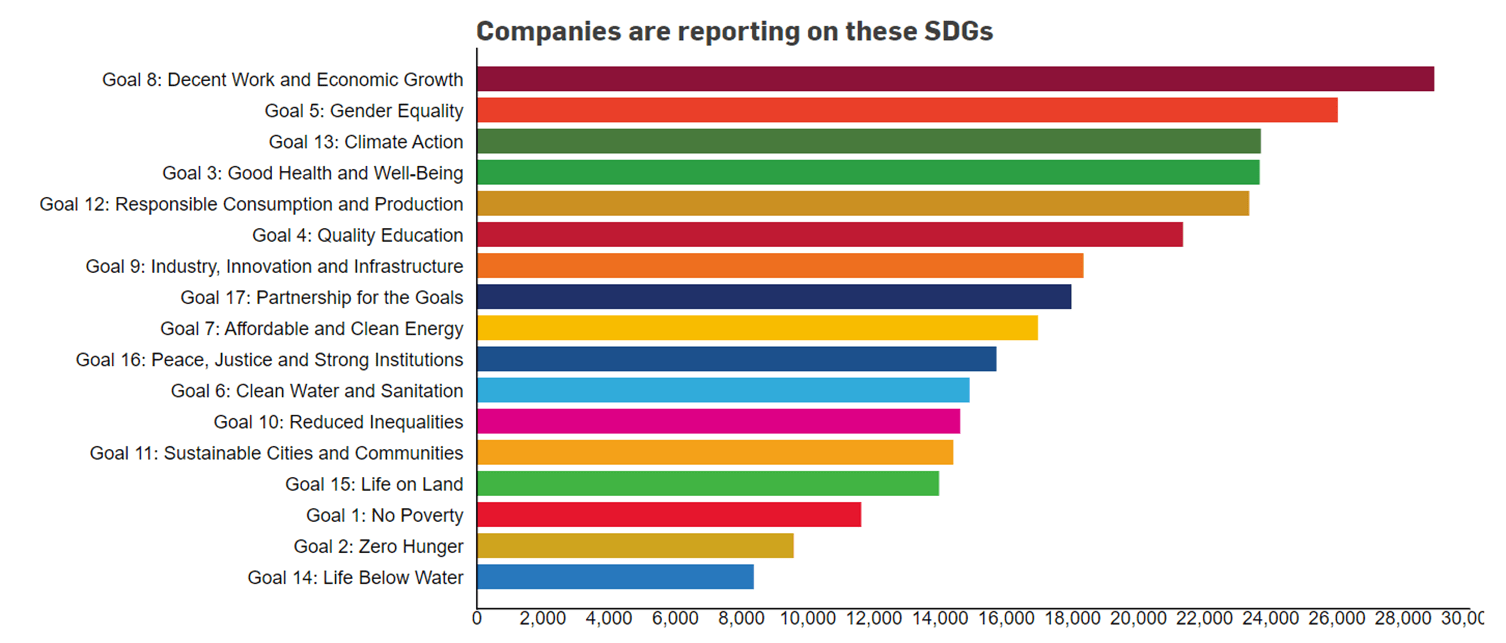

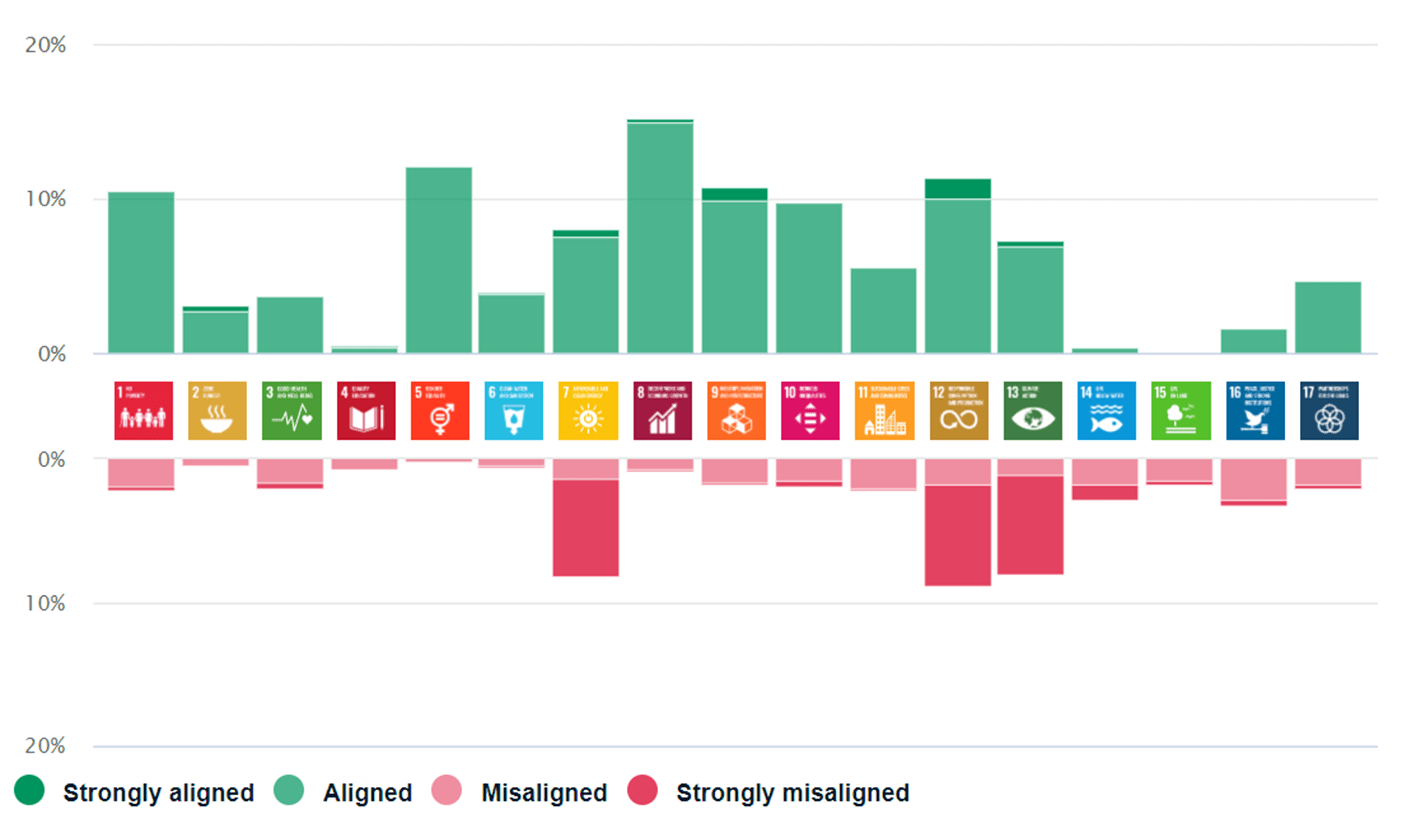

Once the ESG data is collected and reporting standard selected, it’s not typically a huge lift to report to multiple ESG reporting frameworks. The United Nations Sustainable Development Goals (UN SDGs) are one framework companies may want to consider when establishing their ESG strategy. They provide a great lens for companies to share with their stakeholders how they are contributing positively to global societal and environmental issues. The UN Global Compact also provides a guide to help companies integrate the SDGs into their reporting that aligns with the UN Guiding Principles and the GRI standards.

Infographic: ESG topics and SDG ESG mapping

The following infographic makes it easy to align your ESG data with the UN SDGs. It illustrates the detailed topics or impact areas under each ESG pillar and how each pillar maps to the SDGs. We will define each of the ESG topics in the future editions of this series.