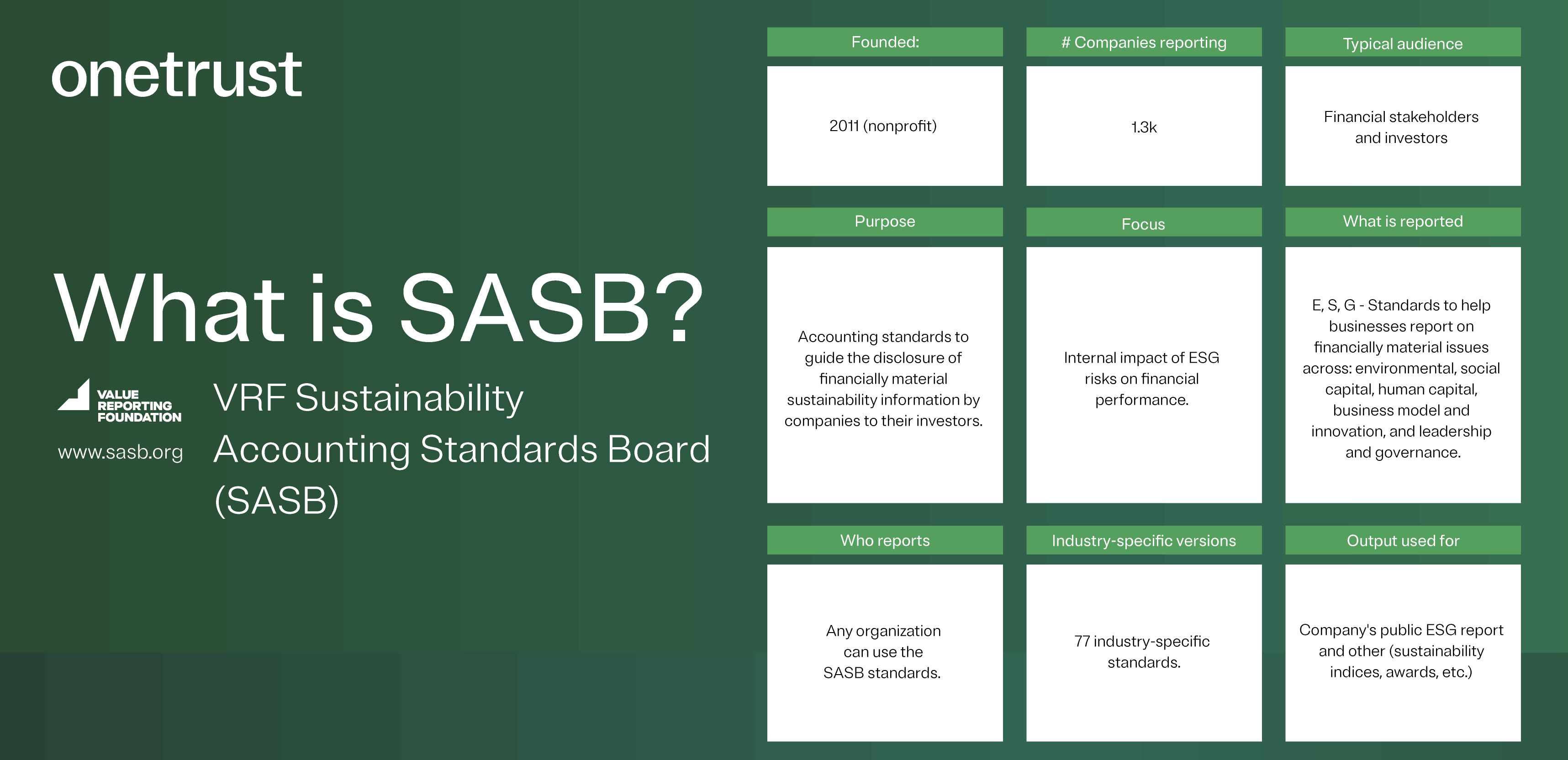

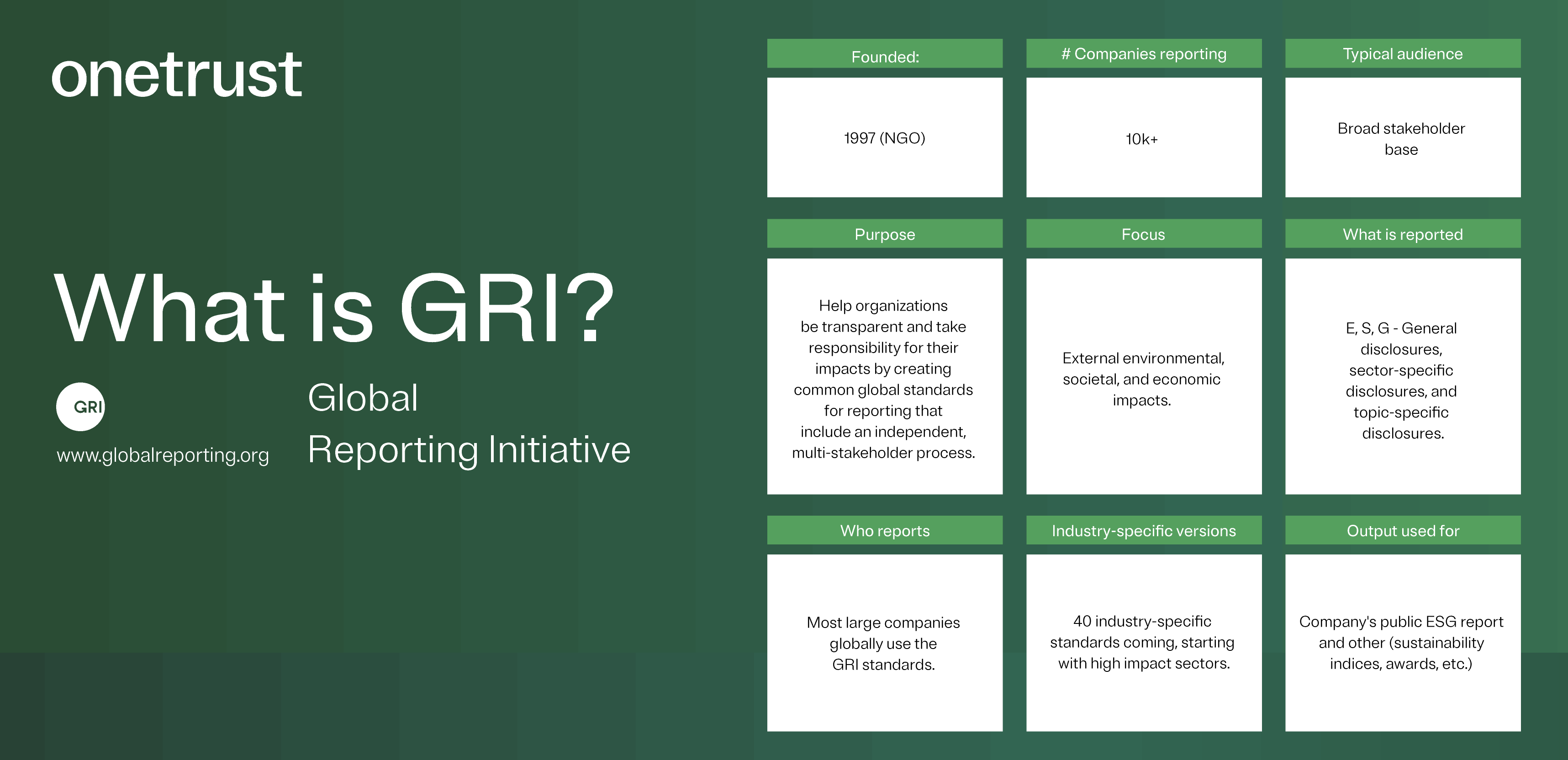

Sustainability professionals have a lot to contend with, including multiple stakeholders, data sources, standards, laws, and ESG reporting frameworks. Multinational companies in particular face more than 2,600 climate laws and policies and nearly 2,000 ESG reporting provisions that can affect the way they disclose sustainability matters. Fortunately, recent developments give strong indication that a consolidated set of global ESG disclosure standards is coming. These include announcements by the International Sustainability Accounting Standards Board (ISSB), the U.S. Securities and Exchange Commission (SEC), and more. One thing these announcements have in common is the mention of ESG reporting frameworks and standards that have been widely adopted by the private and public sector: SASB, TCFD, WEF, CDP, and GRI, to name a few. By understanding how each of these sustainability reporting standards work, how they are unique, and how they complement each other, businesses can build ESG programs that meet stakeholder needs. To make the job easier, we’ve broken down three of these ESG frameworks for a side-by-side comparison – CDP vs SASB vs GRI.

Download the infographic for a side-by-side comparison of three major ESG reporting frameworks.

What is CDP reporting?

CDP, formerly known as the Carbon Disclosure Project, is an investor-led nonprofit focused on motivating and supporting companies, cities, states, and regions to measure and disclose their environmental impacts. It runs a global disclosure system, known as the CDP Online Response System (ORS), that organizations use to report sustainability information requested by their stakeholders. CDP also uses the data supplied through ORS to benchmark organizations on their sustainability performance across four key areas: climate change, forests, water security, and supply chain. Read the CDP blog and explore the graphic that follows for an overview of the CDP reporting framework:

- Founded: 2000

- Number of companies reporting: Over 13,000

- Typical audience: Investors and customers who are requesting disclosure.

- Purpose: Motivate governments and companies to disclose their environmental impacts and take action to reduce them.

- Focus: External environmental impacts for requesting stakeholders.

- What is reported: The E and G pillars. Environmental disclosures related to climate change, water security, forests and supply chain.

- Who reports: Cities and companies responding to investor or customer request; voluntary submission.

- Industry-specific versions: High impact industries have additional reporting requirements.

- Output used for: Response to investor or customer inquiry, CDP public scoring (optional).