The latest IPCC report makes it clear that we are at a critical juncture for securing a livable future. According to IPCC Working Group Co-Chair Jim Skea: “It’s now or never if we want to limit global warming to 1.5°C (2.7°F). Without immediate and deep emissions reductions across all sectors, it will be impossible.” Fortunately, there is also increasing evidence of positive climate action, including a growing number of nationally regulated ESG disclosure requirements driving cleaner and more efficient energy and reduced deforestation. Most recently, Canada announced, and the UK enacted, new ESG legislation requiring climate disclosure from certain companies based on the Task Force on Climate-related Financial Disclosures (TCFD) framework.

To learn how to set up your ESG program and reporting for success, download the Ultimate guide to ESG management essentials

What is the new ESG legislation in Canada and the UK?

TCFD ESG disclosure requirements in Canada

On April 8, Canada released a new budget that will require federally regulated financial institutions to publish climate-related risks and disclosures aligned with the TCFD framework, starting in 2024. This includes all the country’s banks, insurance companies, and federally incorporated or registered trust and loan companies, among others. Canada’s financial regulator, the Office of the Superintendent of Financial Institutions (OSFI), will also expect financial institutions to collect and assess information on climate risks and emissions from their clients, although no details are available yet. The Canadian government also plans to move forward separately with ESG disclosure requirements, including climate-related risks, for federally regulated pension plans.

TCFD ESG regulatory requirements in the UK

Starting April 6, 2022, more than 1,300 of the largest UK-registered businesses are now required to disclose climate-related financial information in line with the TCFD recommendations. This includes many of the U.K.’s largest traded companies, banks, and insurers, as well as private businesses with more than 500 employees and £500 million in turnover.

What is the TCFD?

The TCFD is an industry-led task force focused on improving corporate transparency around climate risk in financial disclosures to help investors make better decisions. It was launched at the Paris COP21 in 2015 by the Financial Stability Board (FSB) to develop recommendations on the type of climate risk information that companies should disclose to their stakeholders. Currently chaired by Michael R. Bloomberg, founder of Bloomberg L.P., the task force consists of 31 members from across the G20 who represent both preparers and users of financial disclosures. By developing a framework for more effective climate-related disclosures, the TCFD aims to:

- Promote more informed investment, credit, and insurance underwriting decisions.

- Enable stakeholders to better understand the concentrations of carbon-related assets in the financial sector and the financial system’s exposure to climate-related risks.

In Michael Bloomberg’s words: “Increasing transparency makes markets more efficient and economies more stable and resilient.”

What are the TCFD recommendations? What are the TCFD four pillars?

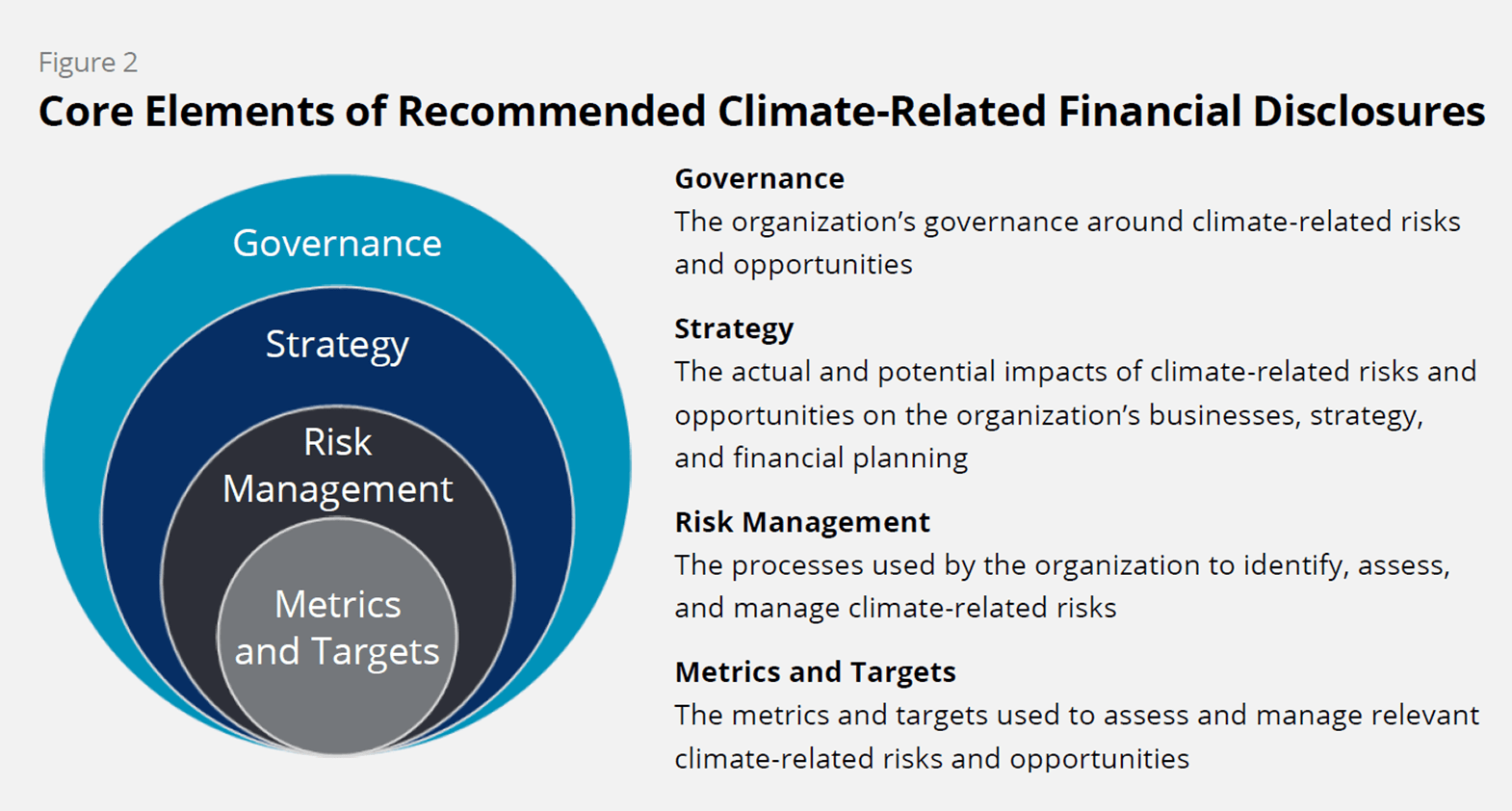

In June 2017, the TCFD released its final recommendations for climate-related financial disclosures. They are applicable to organizations across sectors and jurisdictions and are structured around four thematic areas:

- Governance: The organization’s governance around climate-related risks and opportunities.

- Strategy: The actual and potential impacts of climate-related risks and opportunities on the organization’s business, strategy, and financial planning.

- Risk management: The processes used by the organization to identify, assess, and manage climate-related risks.

- Metrics and targets: The metrics and targets used to assess and manage relevant climate-related risks and opportunities.