Welcome to the next edition of the Trust Geek Glossary, where we aim to clear up the alphabet soup that comes with the trust profession. If you caught the last installment, you may already be using terms like CDP, DSAR, or GHG with ease. But stay tuned as today’s post will dive into another sustainability reporting framework – the Sustainability Accounting Standards Board (SASB). We’ll explore key questions about SASB standards, the SASB materiality map, and more.

Download the infographic for a side-by-side comparison of three major ESG reporting frameworks.

What is SASB?

SASB was a nonprofit founded in 2011 by Dr. Jean Rogers, an environmental engineer and former Loeb Fellow at Harvard University. SASB was developed during research conducted by Rogers and her colleagues at Harvard’s Initiative for Responsible Investment. The goal was to address the value gap between information provided in traditional financial statements and the sustainability factors that can impact a company’s long-term ability to create value. In Roger’s own words, she founded SASB because:

“Material information is the right of every investor….to get a full picture of corporate performance, investors need to be able to type in a ticker and access sustainability fundamentals right alongside financial fundamentals.”

Initially focused on helping companies operating in the U.S. disclose financially material sustainability information to their investors, SASB has since gained global acceptance. Today 258 institutional investors across 23 countries support and/or use SASB standards to inform their decision-making. In 2021, SASB and the International Integrated Reporting Council (IIRC) merged into a single organization called the Value Reporting Foundation (VRF) in response to investor demand for simplification of sustainability disclosures.

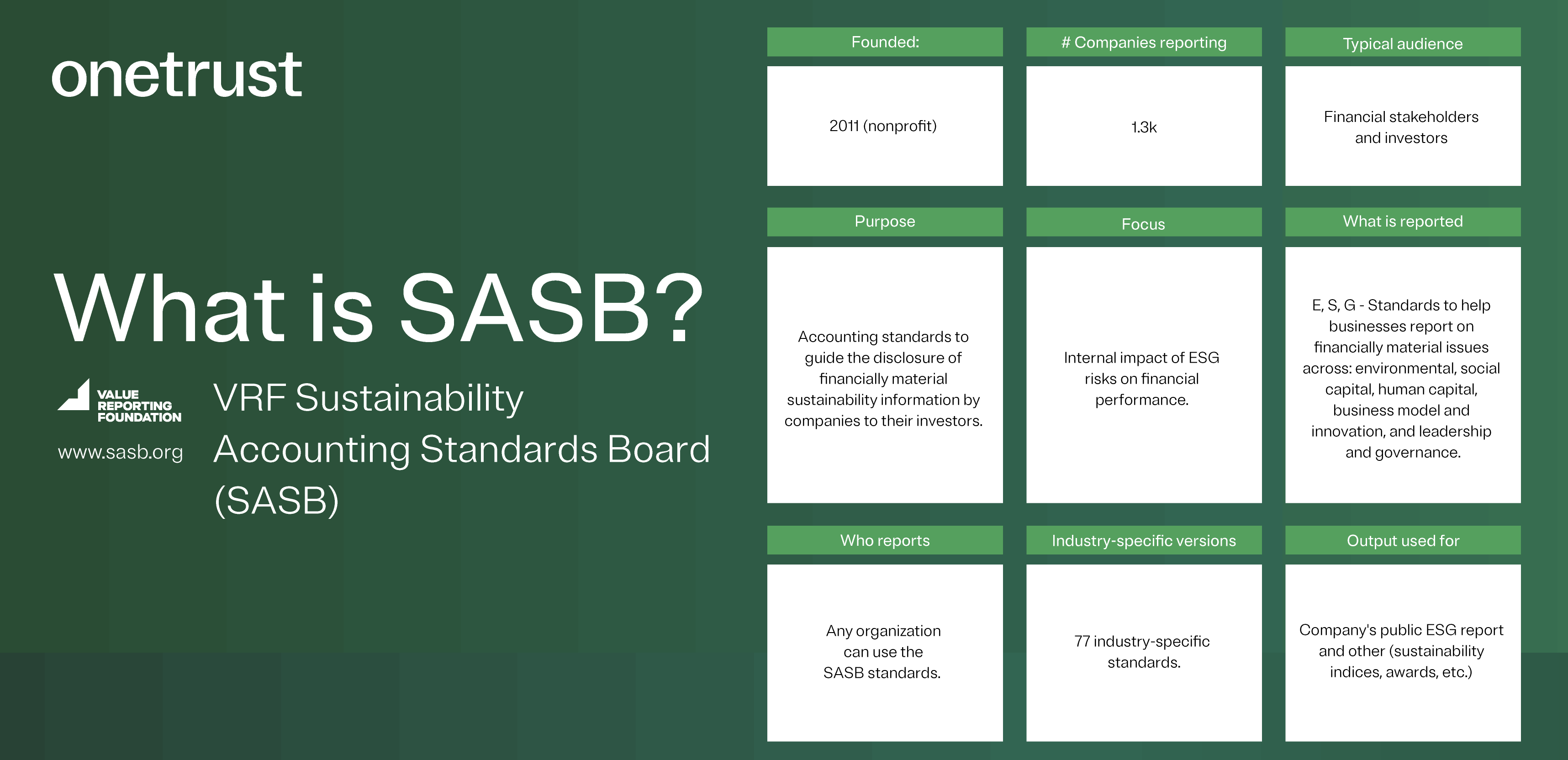

What is SASB infographic

The infographic that follows provides a quick introduction to SASB:

- Founded: 2011

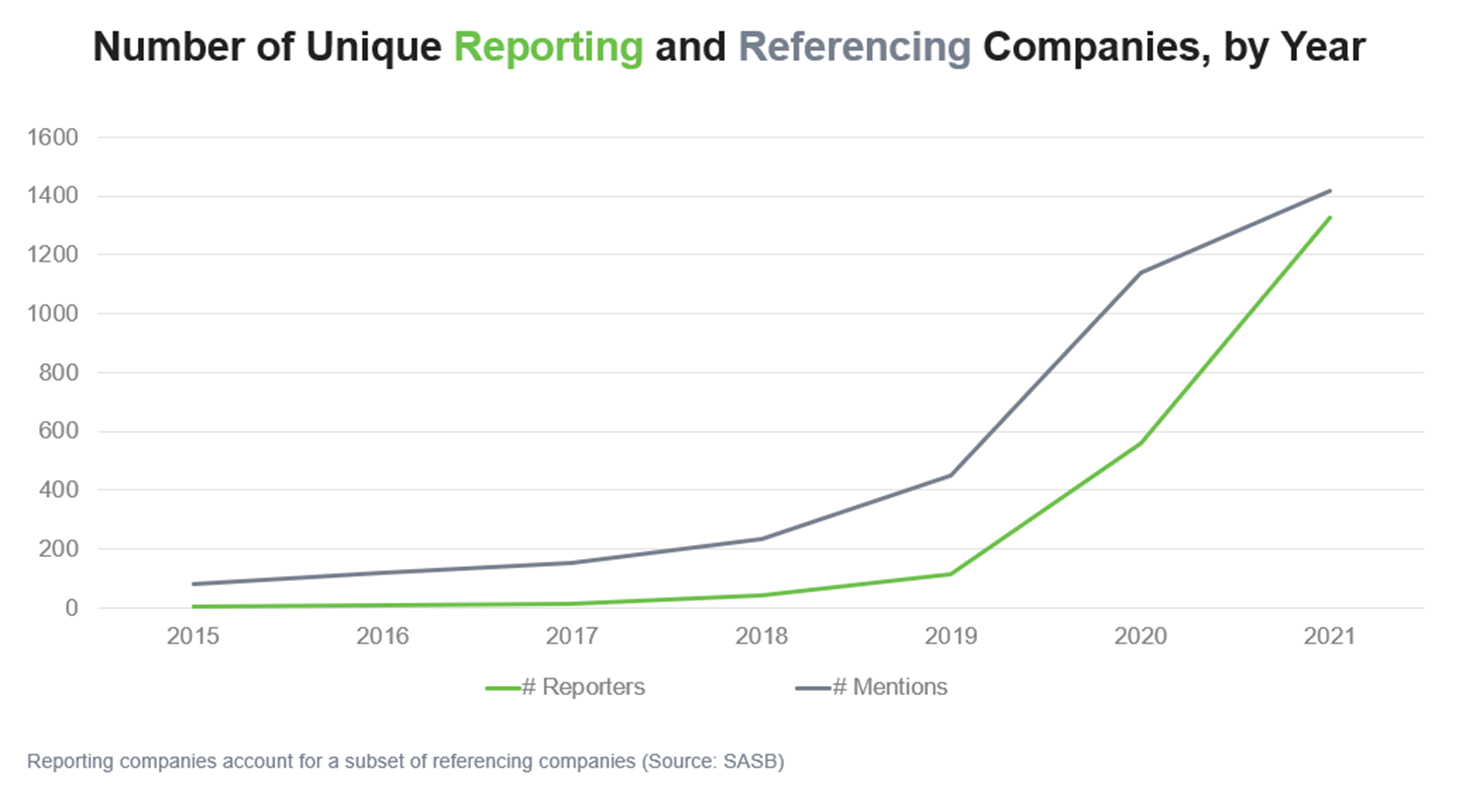

- Number of companies reporting: 1,300

- Typical audience: Financial stakeholders and investors

- Purpose: Accounting/reporting standards to guide the disclosure of financially material sustainability information by companies to their investors.

- Focus: Internal impact of environmental, social, and governance (ESG) risks on financial performance.

- What is reported: All three ESG pillars. These standards help businesses report on financially material issues across environmental, social capital, human capital, business model & innovation, and leadership & governance.

- Who reports: Any organization can use the SASB standards.

- Industry-specific versions: 77 industry-specific standards.

- Output used for: Company’s public ESG report and other (sustainability indices, awards, etc.)