Most large businesses today publish ESG sustainability reports. But one of the challenges with voluntary ESG reporting is lack of consistency in the information shared. Businesses can choose which ESG reporting framework to use and what to disclose (or not). This makes it difficult for investors and other stakeholders to compare apples to apples when it comes to ESG risks and impacts.

And policymakers are taking note. Several countries have passed or proposed new regulations to improve corporate transparency and accountability around these risks and impacts. In 2022, the US announced new climate disclosure rules for companies and investment advisors. It also unveiled a new federal ESG disclosure rule as part of its plan to become net zero by 2050. Germany passed a due diligence law that requires companies to divulge ESG risks and impacts in their supply chain, and the Dutch Parliament introduced consultation on a similar bill. More recently, the European Parliament approved one of the most important new ESG disclosure rules to date: the Corporate Sustainability Reporting Directive (CSRD). Companies that are affected by the EU CSRD ESG regulation will need to provide detailed reports on their operations, as well as their environmental, social, and governance (ESG) impacts.

Download the eBook: Ultimate guide to the EU CSRD

What is the Corporate Sustainability Reporting Directive ESG regulation?

The EU Corporate Sustainability Reporting Directive (CSRD) is a policy requiring large companies and public-interest entities operating in the EU to disclose information on their ESG performance annually. The European Council approved the CSRD on November 28, and it was published in the Official Journal of the European Union (OJEU) on Dec 16, 2022. It will enter into force 20 days after publication, and member states then have 18 months to integrate the new rules into their national laws as an ESG regulation.

The purpose of the EU CSRD is to improve transparency and accountability around corporate ESG performance. This will help investors and other stakeholders have a better understanding of how these companies are addressing ESG issues, so they can make more informed decisions. The CSRD also seeks to accelerate integration of ESG considerations into corporate business practices to support the transition to a more sustainable, inclusive economy.

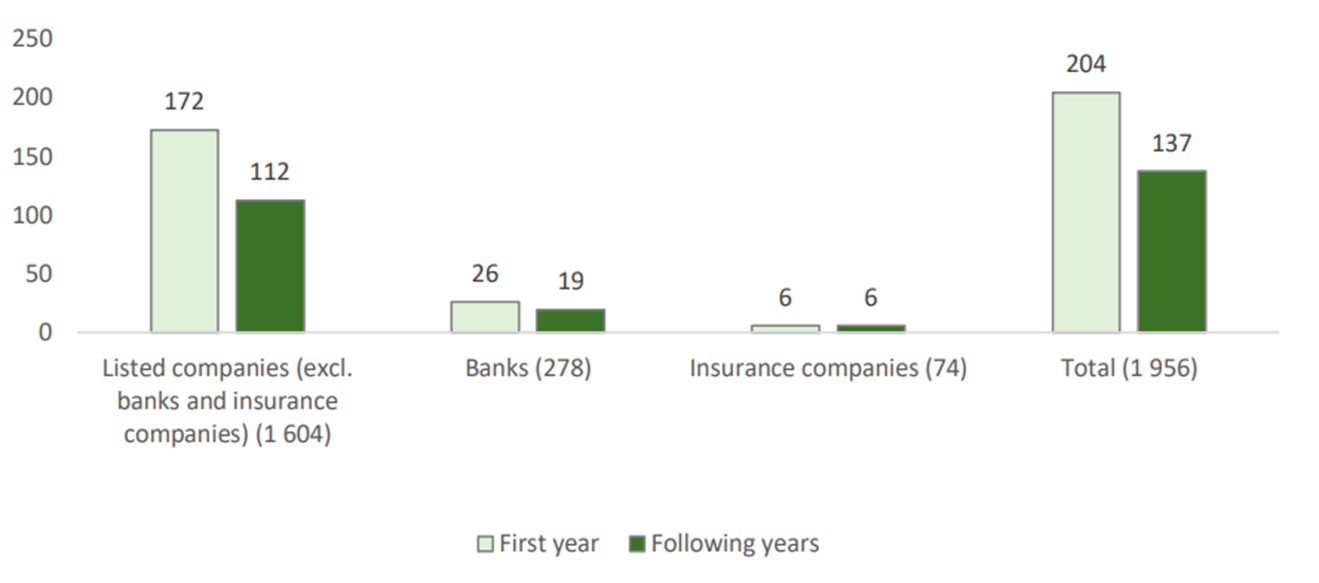

The CSRD replaces the Non-Financial Reporting Directive (NFRD), expanding the number of companies that will have to comply by nearly four times (from nearly 12,000 to 50,000). In-scope companies will need to prepare a non-financial statement that discloses information on their policies, risks, impacts, and outcomes relating to ESG issues. The statement must be audited by an independent third-party and included in the company’s annual financial report.

Is the EU CSRD mandatory? Which companies are affected?

The CSRD is mandatory for in-scope companies, which include the following:

- Listed companies

- Large companies that meet two of these criteria: More than 250 employees, net turnover of more than EUR 40 million, or total assets exceeding EUR 20 million.

- Non-EU companies with at least one subsidiary in the EU and a net turnover of more than EUR 150 million.

When do companies have to start reporting for the CSRD?

Companies meeting the criteria will need to start reporting:

- Jan 2025 for companies already subject to the NFRD (based on 2024 fiscal year data).

- Jan 2026 for all other companies (based on 2025 fiscal year data).

- Jan 2027 for listed small and medium enterprises that request an extension (based on 2026 fiscal year data).

Why was the CSRD adopted?

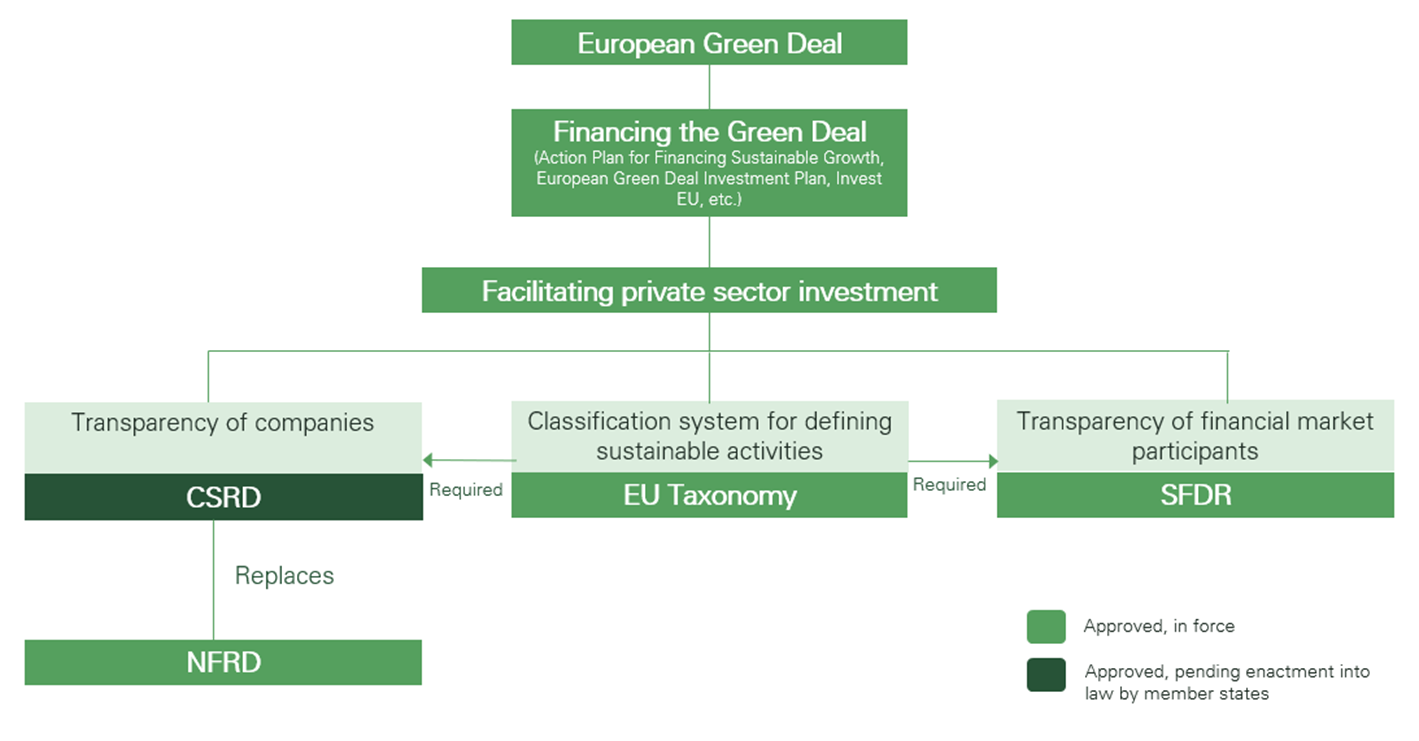

The CSRD is part of the European Green Deal, a set of policies and initiatives focused on shifting the EU to a more sustainable, responsible, and digital economy. To help fund the Green Deal, the EU launched the Action Plan for Financing Sustainable Growth that outlines reforms in three areas:

- Moving capital flows toward sustainable investment.

- Mainstreaming sustainability into risk management.

- Fostering transparency and long-termism in economic activity

The CSRD is a key supporting element of this plan. By requiring companies to disclose finance-grade information on their ESG performance in their annual reports, it will improve the transparency, credibility, and comparability of this data. This will help investors and other stakeholders make informed decisions about the companies they engage with, funneling more capital toward sustainable businesses and investments. It also facilitates greater corporate accountability by encouraging companies to integrate ESG considerations into their business practices.

“The new rules will make businesses more accountable for their impact on society and will guide them towards an economy that benefits people and the environment. Data about the environmental and societal footprint would be publicly available to anyone interested in this footprint.”

Jozef Síkela, Czech Republic Minister for Industry and Trade

How does the CSRD relate to the European Green Deal, EU taxonomy, and SFDR?

The CSRD, EU Taxonomy, and Sustainable Finance Disclosure Regulation (SFDR) are all key policies supporting the European Green Deal and EU Action Plan for Financing Sustainable Growth. They aim to improve private sector transparency and accountability around ESG impacts and risks to promote sustainable economic growth and investment in the EU.