Two-thirds of risk professionals say fragmented and siloed data significantly slows their ability to respond to risks, according to PwC’s Global Risk Survey.

Many organizations today struggle with inefficient, siloed risk and issue management practices, leading to high costs and missed insights.

"As technology, data, and AI accelerate risk exposure, businesses can't afford to lag behind," said Kaitlyn Archibald, Product Marketing Director at OneTrust. "The key is turning insights into action — fast — to drive growth and stay ahead of emerging threats. OneTrust's new risk capabilities provide an enterprise-wide, scalable risk experience, enabling companies to use risk insights as a strategic tool to protect the business while driving growth that helps the organization meet its objectives."

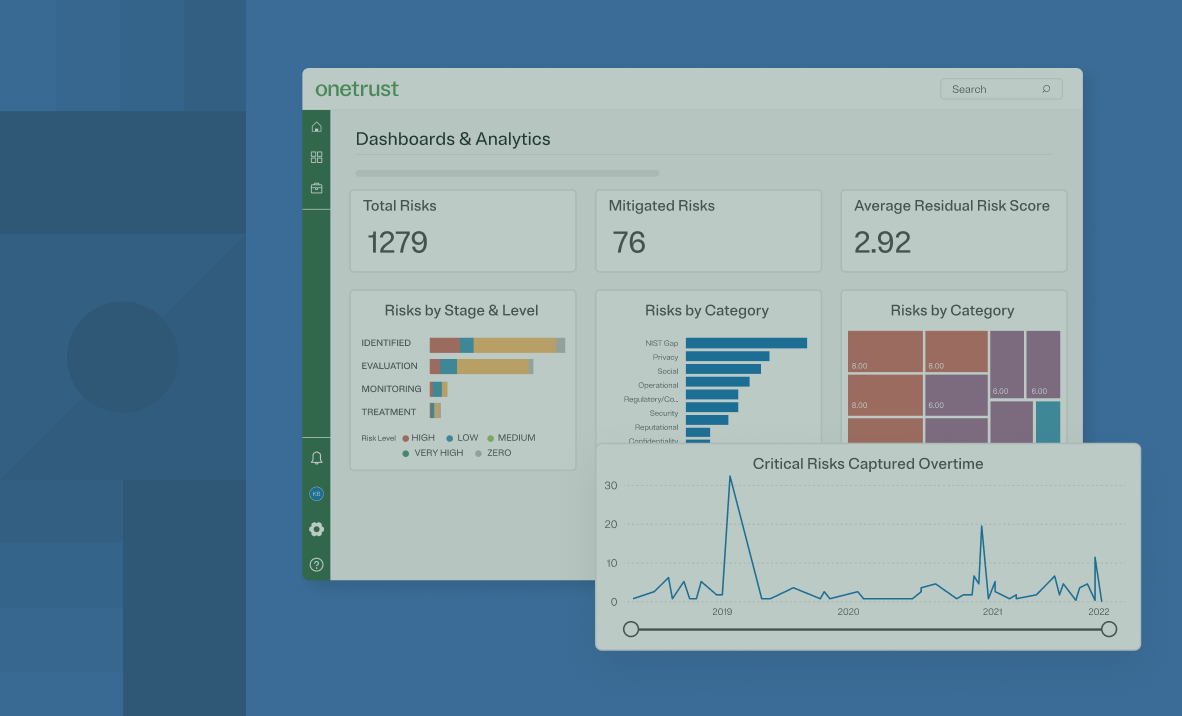

OneTrust's new risk capabilities help businesses see the big picture with the ability to quickly dive into deeper details when needed, delivering a clear view of business impact to drive action that supports business growth.

Deliver configured insights, without the complexity

Traditional reporting structures often get overwhelmed with data, making it hard to turn operational details into meaningful insights. Legacy tools try to solve this with heavy customization, but they’re resource-intensive and fall out of sync with evolving business needs.

OneTrust offers a smarter approach — bridging top-down strategy with bottom-up visibility. By integrating directly into key IT, third-party, and privacy risk workflows, teams can update and manage risk in real time. Organizations can build a flexible risk taxonomy that adapts to different levels of impact, improves visibility, and encourages proactive risk ownership. With built-in risk mappings, guided workflows, and easy user-driven configuration, OneTrust makes it simple to scale and evolve your risk approach over time.

Here’s how OneTrust makes it possible:

- Business Objectives: Align risk with business priorities — to inform leadership with context and ensure risk decisions directly support strategic goals.

- Risk Hierarchy: Map how parent, child, and adjacent risks interconnect and roll up to drive enterprise-wide visibility.

- Aggregated Scoring: Automate risk metrics that streamline reporting across cascading risk throughout the business.

- Risk Appetite & Tolerance: Monitor risk within or outside defined thresholds to automate actionable notifications and workflows.

These new risk management enhancements empower stakeholders across the organization:

- Executive leadership can access risk insights and understand the business posture on demand with automation to drive connected, contextual reporting.

- Risk leaders can help break down cross-functional silos across risk teams and quickly translate risk management activities as a value-add workstream for the organization to achieve business objectives.

- Risk managers can inform mitigation and prioritization based on associated risk and strategic goals.

Risk flows throughout your organization’s systems and data, and without mapping or monitoring, your company’s security posture is constantly under pressure. Learn more about building a risk-resilient enterprise in this eBook.