Streamline compliance with 55+ ready-to-action frameworks, prescriptive content, and evidence requirements broken down into measurable tasks.

Tech Risk and Compliance

Simplify compliance and effectively manage risks

Scale your resources and optimize your risk and compliance lifecycle.

Automate framework compliance

Streamline business collaboration

Connect teams with 200+ pre-built integrations, a user-friendly portal, and automated workflows designed to expedite remediation.

Gain enterprise-wide risk awareness

Map systems, data, and risks in one view. Prioritize action with dynamic scoring and strategic impact insights.

Understand the impact of automation on your organization’s security

Scope your compliance program

Enable scalable, audit-ready compliance for InfoSec and IT teams by efficiently scoping your compliance responsibility.

KEY CAPABILITIES

Initiate a scoping survey to understand compliance responsibility and areas of overlap

Save time with ready-to-use standardized frameworks and a control library for evidence collection tasks

Efficiently manage your compliance program

Eliminate the guesswork of control design and streamline evidence collection across the business to automate governance, risk, and compliance (GRC).

KEY CAPABILITIES

Centralize your compliance processes and automatically generate required controls and evidence tasks based on your operations with insights across 300 jurisdictions

Collect once, comply across 50+ frameworks with our proprietary shared evidence framework

Streamline your policy, risk, and control review processes with robust workflows and automation rules

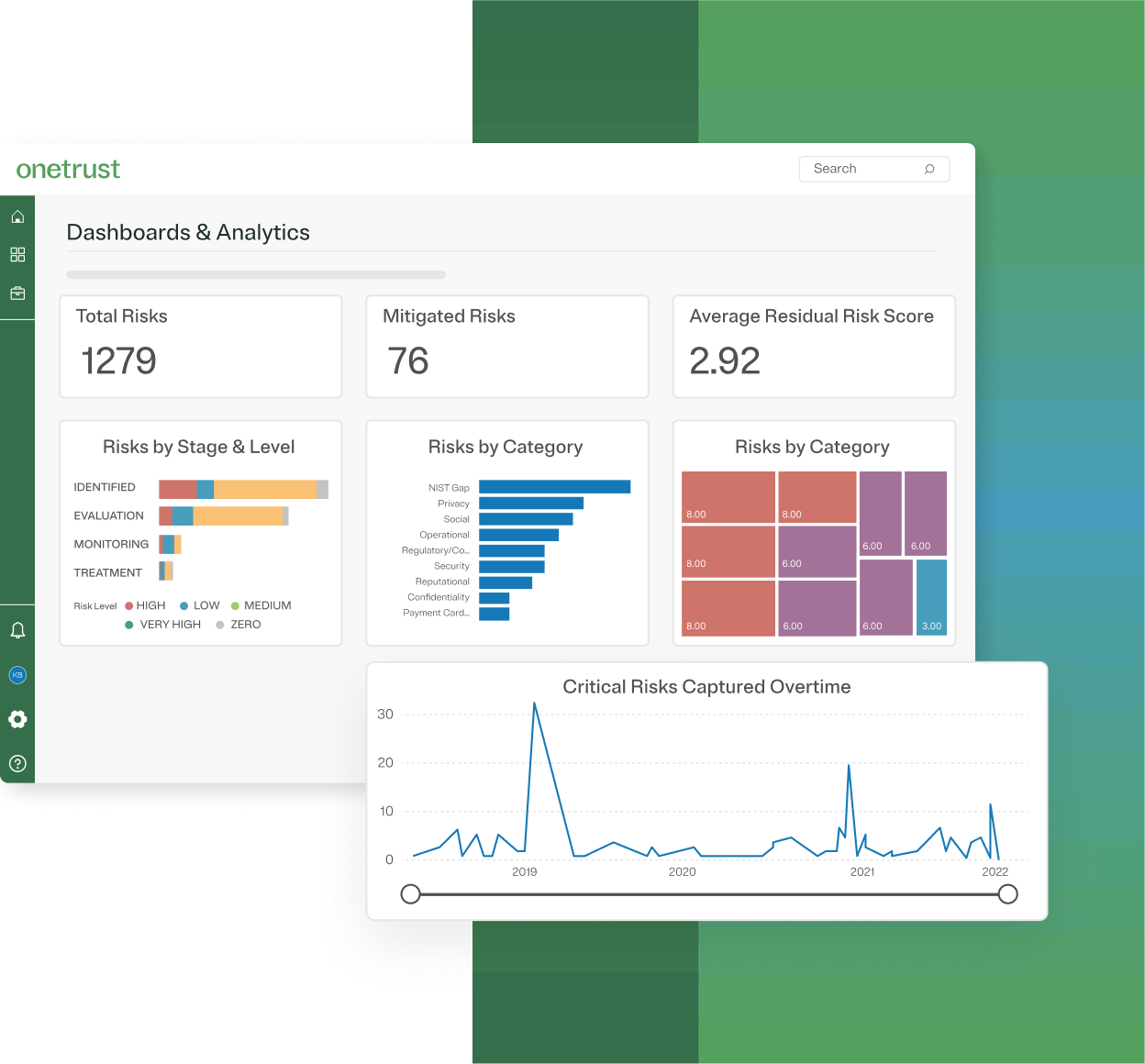

Monitor and mature your program

Review trends and performance to measure, evaluate, and communicate your compliance posture.

KEY CAPABILITIES

Automate reporting with dynamic, real-time dashboards

Promote a culture of self-reporting with expanded risk and incident intake options

Drive enterprise visibility with ease and quickly establish integrations with our visual builder or access the integrations gallery with 500+ pre-built system connectors

Identify, assess, and prioritize risk mitigation

Automate the mapping of systems, data, and risk flowing throughout your internal and external enterprise.

KEY CAPABILITIES

Maintain an evergreen asset inventory

Leverage flexible risk aggregation and scoring

Build logic into your risk assessment to automate the translation of first-line business information to second-line risk and control identification

Identify, remediate, and report issues and incidents

Manage issue and incident response workflows — from intake through remediation.

Empower enterprise-wide GRC

Eliminate data lags and increase adoption with an intuitive experience for light and heavy users alike.

KEY CAPABILITIES

Engage non-compliance stakeholders with measurable evidence tasks

Integrate directly with your tech stack to automate evidence collection with pre-architected collectors

Simplify configuration updates without the need for IT resources with UI-driven configuration

Centralize policy information and track approvals

Provide employees with a single portal for policy access, reporting, and attestation — while maintaining audit-ready version control and approval workflows.

KEY CAPABILITIES

Build a policy development and approval workflow to reflect your unique process including existing terminology, phases, and reviewers

Generate evergreen policy links to maintain the latest version across private and public-facing domains

Track policy attestations & exceptions with automated follow-up

Featured products

Compliance Automation

Improve compliance visibility across frameworks and business scopes with continuous controls monitoring

Learn moreIT Risk Management

Map, measure, and action IT risk in real-time to scale your risk management programs

Learn moreProven results

"We were able to map the assessment of not only cyber risk but also of many other types of risks – such as compliance."

Nunzio Bucello, CISO, Sara Assicurazioni

226k

Risks mitigated annually

On average, OneTrust Tech Risk & Compliance customers mitigated 226,000 risks per year.

75%

Productivity boost

“OneTrust customers recognize up to 75% in productivity enhancements based on process automation."

Partnering with the best

Our Tech Risk & Compliance service partners and technology partner integrations make it even easier for you to scale your resources and automate compliance.

Service partners:

Technology partners:

You may also like

Webinar

Technology Risk & Compliance

Taming compliance complexity: Strategies for scaling across frameworks, systems & geographies

Discover how to scale compliance programs amid rising regulations and complexity. Gain actionable strategies to streamline controls, audits, and global oversight.

July 23, 2025

On-Demand

Responsible AI

Building AI governance with security at the center

Discover how security leaders are securing AI models, data, and infrastructure while driving risk-aware AI governance programs.

July 10, 2025

On-Demand

Technology Risk & Compliance

Unifying third-party and tech risk in an AI-driven world

Join our webinar to learn how risk and security leaders are aligning third-party and tech risk for scalable, AI-ready compliance programs.

July 08, 2025

Webinar

Technology Risk & Compliance

The automation advantage: Unlocking ROI from risk and compliance

Learn how automation reduces compliance costs, boosts audit readiness, and delivers 75%+ time savings across the compliance lifecycle in this practical, ROI-focused session.

May 28, 2025

Webinar

Privacy Management

OneTrust Spring Release

We explore the latest release which introduces AI-assisted features that help privacy and third-party risk teams scale by reducing manual effort and friction, so they can focus on the work that matters most.

May 27, 2025

eBook

Technology Risk & Compliance

The risk-resilient enterprise: Automating compliance for security & scale

Risk flows throughout your organization’s systems and data, and without mapping or monitoring, your company’s security posture is constantly under pressure.

April 24, 2025

Webinar

Technology Risk & Compliance

From reactive to resilient: Building and scaling a modern enterprise risk program

Join our masterclass for CISOs & InfoSec leaders to build scalable, modern risk management programs. Gain actionable strategies, frameworks, and real-world insights for success.

April 22, 2025

Webinar

Technology Risk & Compliance

Harmonizing risk and compliance: Unifying InfoSec programs through automation

Join this webinar to discover how to streamline ISO 27001, GDPR, NIST & PCI DSS with automation, reduce manual work and enhance oversight.

April 09, 2025

Infographic

Technology Risk & Compliance

Automating compliance mitigates risk

Download our infographic to learn steps involved in compliance automation and how it mitigates risk in your organization's security program.

March 27, 2025

Webinar

Technology Risk & Compliance

Operational resilience in a changing world: Going beyond compliance

Join this session to unpack key regulations, such as ISO 27001, APRA CPS 230, DORA, & SOC2, to learn how they impact internal & third-party operations.

February 20, 2025

Webinar

Technology Risk & Compliance

Compliance Automation product showcase

Join our live demonstration and see how Compliance Automation can help boost compliance efficiency with automated workflows, shared evidence, and 40+ frameworks.

December 19, 2024

Webinar

Technology Risk & Compliance

The PDPL in Saudi Arabia is now in effect: is your business ready?

Join our Saudi Arabia PDPL webinar for an overview on the data protection law, its requirements, and how to prepare for full enforcement.

December 12, 2024

Webinar

Technology Risk & Compliance

Elevating client compliance with OneTrust Automation: Key strategies for partners

Discover how to use OneTrust Compliance Automation to establish client baselines, improve efficiency, and drive scalability. Learn key strategies to enhance your compliance impact.

December 11, 2024

Webinar

Technology Risk & Compliance

Understanding the NIS 2 Directive: Compliance insights and best practices

This DataGuidance webinar explores the latest and expected developments in the implementation of the NIS 2 Directive, focusing on practical compliance strategies to ensure your organization is prepared.

December 04, 2024

Webinar

Technology Risk & Compliance

Tech risk and compliance masterclass: An evidence-based approach to building by-design risk and compliance practices

Discover strategies to embed compliance and risk management into business processes with minimal disruption, using technology-driven solutions for efficiency, scalability, and improvement.

November 06, 2024

Webinar

Technology Risk & Compliance

Building a strong security posture: Managing compliance, risk, and business engagement in a dynamic landscape

Join our webinar to learn how to optimize security posture, streamline compliance, and leverage automation to manage IT risk in today's complex digital landscape. Register now!

October 29, 2024

Webinar

Privacy Automation

Build resiliency and operationalize compliance with OneTrust: Fall product release recap, 2024

Join our upcoming product release webinar to explore how these new capabilities can help your organization navigate complex frameworks, streamline third-party management, and accelerate AI and data innovation.

October 22, 2024

Webinar

Technology Risk & Compliance

Tech risk & compliance masterclass: The anatomy of a framework

Master the fundamentals of constructing robust compliance frameworks that can seamlessly integrate with organizational operations while aligning with regulatory and strategic mandates to deliver measurable insights on your progress and gaps.

August 14, 2024

Webinar

Third-Party Risk

Third-Party Risk Management: From compliance to strategy

Navigate third-party risk challenges and discover strategic steps to scale, automate, and operationalize your program with this webinar series.

August 09, 2024

Webinar

Technology Risk & Compliance

Tech risk and compliance masterclass

Unlock tech risk management & compliance excellence. Master risk management, build robust frameworks, and foster cross-functional collaboration for long-term resilience.

August 07, 2024

Webinar

Technology Risk & Compliance

Introducing OneTrust Compliance Automation

Join us as we explore OneTrust Compliance Automation, a holistic and fully integrated solution that streamlines and optimizes workflows, compliance, and attestation.

July 25, 2024

Webinar

Data Discovery & Classification

Catch it live: See the all-new features in OneTrust's Spring Release and Post-TrustWeek recap

Join us as Ryan Karlin, Senior Director of Product Marketing highlights important updates from TrustWeek including an inside look into OneTrust's new platform features that make it easier for customers to activate data responsibly, surface and mitigate risk, and navigate the complex regulatory environment.

June 06, 2024

Report

AI Governance

GRC strategies for effective AI Governance: OCEG research report

Download the full OCEG research report for a snapshot of what organizations are doing to govern their AI efforts, assess and manage risks, and ensure compliance with external and internal requirements.

May 22, 2024

Infographic

Third-Party Risk

Streamline compliance with the Digital Operational Resilience Act (DORA)

Download our infographic to learn about the new DORA regulation, who needs to comply, and how OneTrust can help streamline the process.

April 29, 2024

Webinar

Ethics Program Management

EthicsConnect: Risk - It’s not just for breakfast anymore

Join us for a deep dive into embedding privacy by design into the fabric of your business to promote the responsible use of data.

April 25, 2024

Infographic

Technology Risk & Compliance

Rethinking risk assessments: Bridging the gap between best practices and action

Download our infographic to learn the main challenges faced during risk assessments, proven frameworks for assessing risks, and how to translate guidance into action.

March 07, 2024

Webinar

Technology Risk & Compliance

PCI DSS Compliance: How to scope and streamline monitoring with Certification Automation

Join our PCI DSS webinar where we discuss how Certification Automation can help free up valuable InfoSec resources, streamline audits, and stay continuously compliant.

March 05, 2024

eBook

Ethics Program Management

Business messaging apps: A guide to corporate compliance

How can your business use third-party messaging apps while staying compliant? Dive into key usage considerations based on the DOJ’s 2023 guidance.

February 13, 2024

Webinar

Technology Risk & Compliance

5 automation trends to modernize InfoSec compliance

Join our webinar for insights on transforming InfoSec program management. Navigate the complexities of modern security with a flexible, scalable, and cost-effective approach.

February 07, 2024

Infographic

Third-Party Risk

4 top-of-mind challenges for CISOs

What key challenges do CISOs face going into the new year? Download this infographic to hear what experts from industries across the board have to say.

January 30, 2024

eBook

Technology Risk & Compliance

NIST CSF 2.0: Changes, impacts and opportunities for your Infosec program

Get your free guide to the NIST Cybersecurity Framework 2.0 and learn how its proposed changes will impact your InfoSec programs.

December 18, 2023

Resource Kit

Technology Risk & Compliance

NIST CSF essentials: Empowering cybersecurity excellence

Download our NIST CSF Essentials resource kit and master cybersecurity compliance with expert insights, strategies, and real-world case studies.

December 15, 2023

Webinar

Technology Risk & Compliance

Demonstrating GDPR compliance with Europrivacy criteria: The European Data Protection Seal

Join our webinar to learn more about the European Data Protection Seal and to find out what the key advantages of getting certified.

November 30, 2023

Data Sheet

Technology Risk & Compliance

Integrations to automate your framework compliance: ISO 27001, SOC 2, and NIST CSF

Explore how OneTrust integrations can help you automate compliance with today’s most popular InfoSec frameworks.

November 28, 2023

Checklist

Technology Risk & Compliance

SOC 2 checklist: 8 steps to achieve compliance

This SOC 2 checklist provides clear action steps that enable you to mature your security program and fast-track your way to compliance.

November 28, 2023

Webinar

Ethics Program Management

Ethics Exchange: Risk assessments

Join our risk assessments experts as we discuss best practices, program templates, and how provide an assessment that provides the best value for your organization.

October 25, 2023

Infographic

Technology Risk & Compliance

Understanding Europe's Top InfoSec and Cybersec Frameworks

Learn the ins and outs of Europe’s top InfoSec and cybersec frameworks, including ISO 27001, UK Cyber Essentials, the NIS2 Directive, DORA, and more.

October 05, 2023

Infographic

Technology Risk & Compliance

5 key areas for improved automation in InfoSec compliance

Streamline and scale your organization’s InfoSec compliance program by focusing on these five key areas of automation.

October 02, 2023

eBook

Technology Risk & Compliance

Prioritizing the right InfoSec frameworks for your organization

In this free eBook, we explore the basics of three top InfoSec frameworks and how to decide which is the best fit for your organization.

September 27, 2023

Webinar

Third-Party Risk

Live Demo EMEA: How OneTrust can help advance your third-party risk management program

Join us for a live demo of OneTrust's third-party risk management solution and see how it can help automate and streamline your TPRM program.

September 19, 2023

eBook

Privacy Management

Responsible data use: Navigating privacy in the information lifecycle eBook

Download this eBook and get the insights you need to safeguard customer privacy and ensure responsible data use in the information lifecycle.

August 22, 2023

Webinar

Technology Risk & Compliance

How to successfully implement ISO 27001 to demonstrate security and assurance across any jurisdiction

Join our live webinar and hear from security professionals on how to get ISO 27001 certified, streamline audit preparation, and demonstrate security assurance across any regulatory jurisdiction.

June 28, 2023

eBook

Third-Party Risk

InfoSec's guide to third-party risk management: Key considerations and best practices

Download our eBook to learn practical advice on how to approach third-party risk management like an InfoSec expert.

June 05, 2023

Webinar

GRC & Security Assurance

Combating InfoSec compliance fatigue: Insights for navigating growingly complex requirements

In this webinar, you will hear first-hand from information security experts experts what are the key pain-points and their strategies to be audit ready.

February 27, 2023

Webinar

Technology Risk & Compliance

Introducing OneTrust Certification Automation: Build, scale, and automate your InfoSec compliance program webinar

In this webinar, learn how to right-size your compliance scope for different frameworks across various business dimensions and enable an agile audit process.

February 15, 2023

Webinar

GRC & Security Assurance

Introducing OneTrust Certification Automation: Reinforce privacy accountability with automated InfoSec compliance

Learn how to enable an agile audit process by breaking down complex InfoSec requirements into actionable tasks to help automate your compliance program.

February 10, 2023

eBook

Technology Risk & Compliance

The future of information security

Learn how to respond to the security landscape and build a proactive InfoSec program to help your customers and business.

October 10, 2022

eBook

Technology Risk & Compliance

The art of the enterprise IT risk assessment

Ensure your enterprise IT risk assessment is a success with a top-down approach that gets executive buy-in from the start

September 16, 2022

eBook

Technology Risk & Compliance

The enterprise DevSecOps playbook

As a unified business function, DevSecOps combines rapid software development with top-notch security at scale.

September 02, 2022

Webinar

GRC & Security Assurance

How to reinforce your InfoSec risk program in a “Not If, But When” incident environment webinar

Learn how scaling your approach to managing IT assets & risk assessments can deliver a complete picture to better measure and inform program investments.

August 16, 2022

Webinar

GRC & Security Assurance

5 critical mistakes to avoid when answering security questionnaires

Avoid these 5 critical mistakes when answering security questionnaires and streamline responses with this webinar.

March 01, 2022

Webinar

GRC & Security Assurance

How successful security teams manage risk to build Trust and drive Growth

Watch this webinar to learn what makes a successful risk management program and how effective security teams build trust.

January 12, 2022

Webinar

Privacy Management

Build an incident management playbook

Prepare for privacy and security incidents by building an incident management playbook.

August 27, 2021

Fundamental to Comprehensive: Where Does Your Compliance Program Stand? Infographic | Resources | OneTrust

Demo

Technology Risk & Compliance

OneTrust Tech Risk and Compliance demo

Manage tech risks and ensure compliance with our all-in-one solution. Automate workflows, scale resources, and measure program effectiveness to stay ahead of evolving regulations.

Learn more about our Tech Risk & Compliance packaged service

FAQ

Yes. Your third-party relationships are a reflection of your organization, which means effective enterprise risk management must extend beyond the walls of your organization. Our Third-Party Management solution streamlines every stage of the vendor lifecycle by automating workflows, like onboarding and ongoing vulnerability assessments, and mitigating risk across your portfolio.