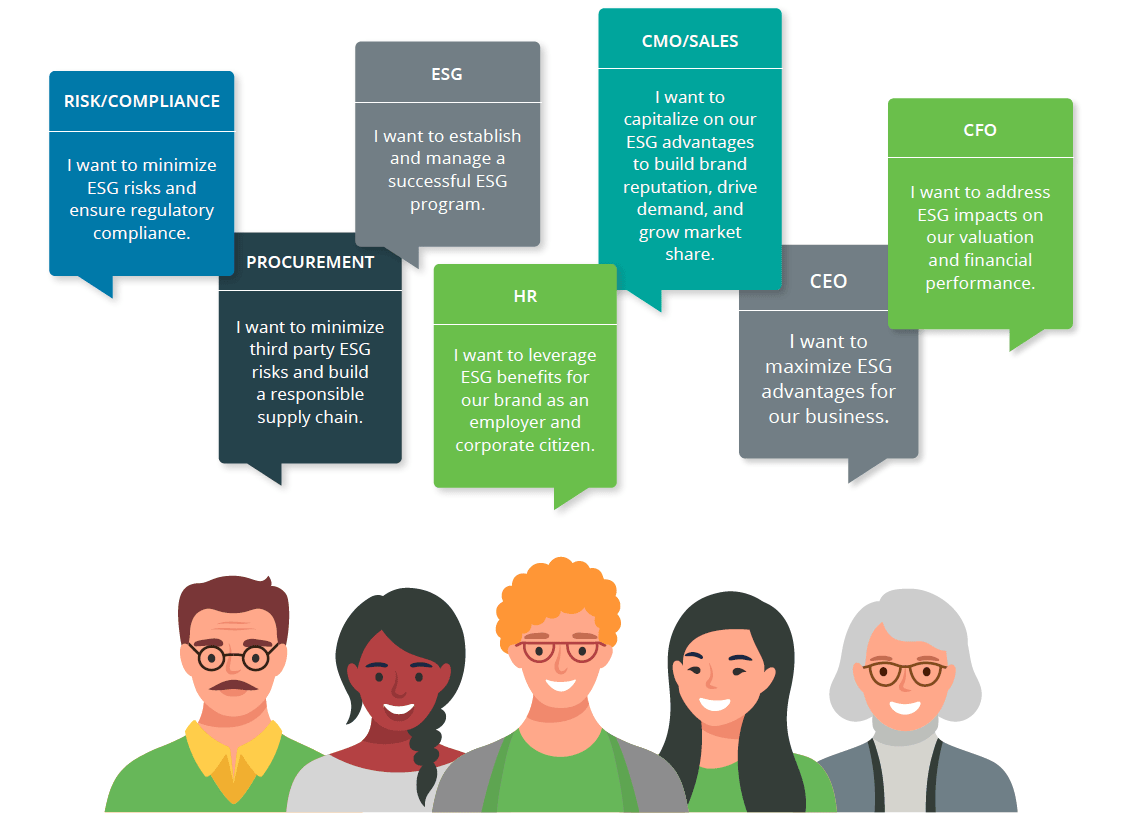

CEO as an ESG stakeholder

A CEO needs to identify, communicate, and manage the risks and opportunities that could impact overall brand image, valuation, or financial performance of the company.

- Focus: Maximizing ESG advantages for our business.

- Pain points: Declining innovation and market share, increasing risks and costs, high turnover

- Audiences: Board, investors, customers, partners, employees

- Needs/Questions:

- What is the ROI of our ESG efforts so I can report to key audiences?

- How can our ESG program help improve our business results, competitive advantage, and brand reputation

- How can our ESG program help reduce risks and costs?

- I want to benchmark our ESG score/rating against others in our industry to identify gaps and opportunities to improve.

- Alternate titles: Founder, President, Executive Director (nonprofits)

CFO/Investor Relations as an ESG stakeholder

A CFO is concerned with identifying, communicating, and managing risks and opportunities that could impact overall valuation or financial performance of the company.

- Focus: Addressing ESG impacts on valuation and financial performance.

- Pain points: Declining valuation and revenues, increasing costs, slower growth without ESG focus, challenges gaining new financing, higher cost of capital, ESG disclosure requirements from investors and regulators

- Primary audiences: CEO, board, investors, regulators

- Secondary audiences: Customers, partners, employees

- Needs/Questions:

- How can our ESG program improve our valuation and financial performance?

- What are the key ESG disclosure regulations, accounting methodologies, and reporting frameworks we need to align with in our financial reporting?

- What is the ROI of our ESG efforts so I can report to key audiences?

- What are the ESG risks that may negatively impact our valuation or revenues? How can we mitigate these risks and reduce costs?

- I want to measure our ESG score/rating to see the impact on our financial performance, reduce risk, and identify gaps and opportunities to improve.

- I need portfolio-level visibility into ESG metrics to make strategic investment decisions and/or to better manage our finances for investor value.

- Alternate titles: Treasurer, Chief Accountant, Chief Investment Officer, Chief Business Officer, Chief Credit Officer, Chief Budget Officer

CMO/Sales as an ESG stakeholder

A Chief Marketing Officer (CMOs) needs to drive leads through marketing programs, platforms, and channels. CMOs may be responsible for public relations (PR), brand, communications, content, digital marketing, product marketing, and more. A Chief Sales Officer is responsible for developing new business and meeting sales/revenue targets.

- Focus: Capitalizing on our ESG advantages to build brand reputation, drive demand, and grow market share.

- Pain points: Negative brand reputation without ESG focus, reputational damage, competitive disadvantage, declining market share, pressure from customers to align with ESG criteria, weakening customer loyalty.

- Primary audiences: CEO, marketing/sales, employees

- Secondary audiences: Customers, partners, board, investors, regulators

- Needs/Questions:

- How can our ESG efforts help improve our brand reputation?

- What ESG advantages can we promote in our marketing and sales outreach?

- What are the ESG risks that may negatively impact our brand or market share? How can we mitigate these risks?

- I want to measure our ESG score/rating and benchmark against others in our industry to see the impact on our brand and identify gaps/opportunities to improve.

- I need to respond to customer RFPs that have specific ESG requirements we need to align with.

- Alternate titles: Chief Brand Officer, Chief Reputation Officer, Chief Communications Officer, Chief Content Officer, Editor in Chief, Chief Web Officer, Chief Business Development Officer, Chief Revenue Officer, Chief Commercial Officer, Chief Growth Officer, Chief Visibility Officer (retail)

HR/Diversity/Culture/Citizenship as an ESG stakeholder

A Chief Human Resources Officer (CHRO) is responsible for all human resources functions in the employee experience including employer branding, talent acquisition, and retention. This may include some additional aspects of the ‘S’ in ESG if it’s not a separate role such as Diversity & Inclusion, Community Relations, or Culture and Purpose.

- Focus: Leveraging ESG benefits for our brand as an employer and as a corporate citizen.

- Pain points: Low employee engagement, high turnover, increasing hiring costs, and negative employer brand reputation without ESG focus. ESG disclosure requirements on S pillar from investors and regulators. Pressure from marketing/sales, customers, partners, and employees to align with ESG criteria.

- Primary audiences: CEO, marketing/sales, employees

- Secondary audiences: Customers, partners, board, investors, regulators

- Needs/Questions:

- How can our ESG program help improve our brand and employee experience?

- What are the key ESG disclosure regulations and reporting frameworks we need to align with for social responsibilities?

- How can our ESG efforts help mitigate our employee and social risks?

- I want to benchmark our ESG score/rating against others in our industry to identify gaps and opportunities to improve.

- Alternate titles: Chief People Officer, Executive Vice President of Human Resources, Chief Talent Officer, Chief Diversity Officer, Chief Inclusion Officer, Chief Culture Officer, Chief People & Culture Officer, Chief Employee Experience Officer, Chief Happiness Officer, Chief Trust Officer, Chief Impact Officer, Chief Social Impact Officer, Chief Purpose Officer, Chief Corporate Social Responsibility Officer, Chief Social Responsibility Officer, Chief Corporate Citizenship Officer

Head of Sustainability/ESG as an ESG stakeholder

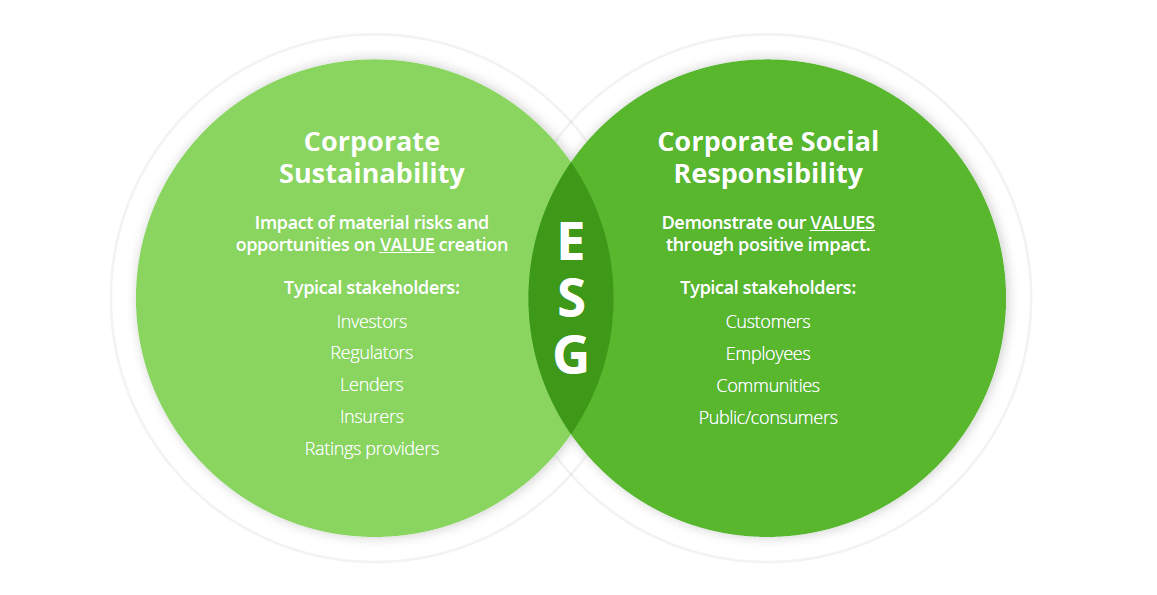

A Chief Sustainability Officer needs to work with functional stakeholders to identify, report on, and track material ESG risks and opportunities for the company. This includes collecting the pertinent ESG data and determining clear, actionable steps for goal setting, reporting, and progress tracking. Understanding and applying key ESG accounting and reporting methodologies is also an essential responsibility.

- Focus: Establishing and managing a successful ESG program.

- Pain points: Challenges integrating ESG objectives and metrics across multiple functional groups, complexity in gathering data, no single globally recognized set of metrics to benchmark ESG progress against, ESG disclosure requirements from investors and regulators, time-consuming to manually report against multiple ESG frameworks, need help with carbon accounting and reduction, inability to track disclosures and goal tracking over time

- Primary audiences: CEO and all internal C-Suite

- Secondary audiences: Customers, investors, regulators, partners, employees

- Needs/Questions:

- How can I prove the business case/ROI for our ESG initiatives to senior leadership?

- I need to identify the material ESG risks and opportunities for our company.

- What are the key ESG disclosure regulations, accounting methodologies, and reporting frameworks we need to align with?

- I need help getting started, calculating ESG metrics, or developing improvement plans.

- I want to reduce the time and effort associated with gathering ESG data and metrics from multiple teams across the organization.

- How can I streamline and automate ESG reporting and progress tracking?

- What’s the best way to drive progress and show results?

- I want to benchmark our ESG score/rating against others in our industry to identify gaps and opportunities to improve.

- Alternate titles: Chief Climate Officer, Head of ESG Reporting, Head of ESG, Chief ESG Officer, Chief Green Officer, Chief Environmental Officer, Chief Environmental Commitment Officer, Chief Carbon Officer, Head of Sustainable Operations, Head of Responsible Business

COO/Procurement as an ESG stakeholder

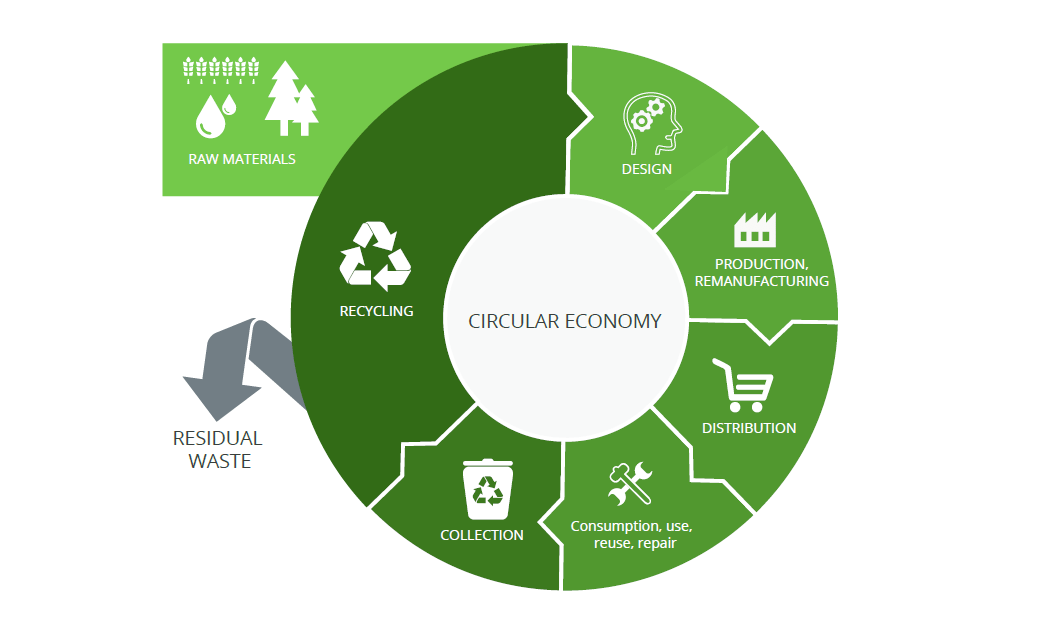

A Chief Operating Officer (COO) needs to understand and address any risks or issues that could impact day-to-day operations (upstream or downstream). Procurement teams have a major role to play in identifying and managing any upstream ESG risks related to third-party partners, suppliers, and vendors that could impact the organization.

- Focus: Minimizing third party ESG risks. Building a responsible supply chain.

- Pain points: Supply chain resiliency to ESG risks, challenges with vetting third parties for ESG risks and opportunities that could impact our operations, negative attention from partnering with third parties that have high ESG risks, negotiation challenges, ESG supply chain disclosure requirements

- Primary audiences: CEO, CFO, Board, partners, regulators

- Secondary audiences: Customers, employees, investors

- Needs/Questions:

- I need to vet our third-party suppliers and partners for key ESG criteria to minimize risk and ensure they are aligned with our requirements.

- How can I identify and manage the third party ESG risks and opportunities that could impact our operations

- What are the key supply chain ESG disclosure regulations, accounting methodologies, and reporting frameworks we need to align with?

- I need portfolio-level visibility into ESG metrics of our suppliers to make strategic partnering decisions.

- Alternate titles: Head of Operations, Chief Supply Chain Officer, Chief Supply Chain Management Officer, Chief Partner Officer, Chief Partnerships Officer, Chief Sourcing Officer

Risk/Compliance/Legal as an ESG stakeholder

Risk/Compliance/Legal Officers must identify and manage any risks that could impact the business, as well as ensure compliance with all relevant regulations.

- Focus: Minimizing ESG risks and ensuring regulatory compliance.

- Pain points: Business resiliency to ESG risks, proliferating ESG regulations and reporting requirements, heightened supply chain/political/reputational/operational risk, regulatory and civil hazards, lack of control and oversight

- Primary audiences: CEO, CFO, COO, Head of ESG, Board, regulators

- Secondary audiences: Customers, employees, partners, investors

- Needs/Questions:

- How can I identify and mitigate ESG risks that could impact our business?

- How can our ESG program help reduce risks and exposure?

- What are the key ESG regulations, accounting methodologies, and reporting frameworks we need to align with?

- How can I include ESG metrics into our risk assessment and management process?

- I want to measure our ESG score/rating to reduce risk and identify gaps and opportunities to improve.

- I need portfolio-level visibility into ESG risks across our value chain to make strategic business resiliency decisions.

- Alternate titles: Chief Risk Officer, Principal Risk Officer, Chief Compliance Officer, Chief Risk and Compliance Officer, Chief Risk Management Officer, Head of Operational Risk, General Counsel, Chief Legal Officer, Chief Security Officer, Chief Ethics and Compliance Officer, Chief Governance Officer, Chief Corporate Governance Officer, Head of Corporate Governance, Head of Compliance and Regulatory Affairs, Head of Compliance and MLRO (EU), Chief Resilience Officer, Chief Resiliency Officer, Chief Privacy Officer, Head of Internal Controls, Chief Underwriting Officer (financial services), Head of Information Security, Information Security Officer, Head of Non-Financial Risk, Head of Remediation, Chief Trust Officer

How to Build the Business Case for ESG

Once you better understand the challenges leaders are facing, you’ll be ready to make your case for how a smart sustainability strategy can help. Be sure to emphasize not only the many ways in which the environment and society benefits, but also the significant advantages the company gains.

These benefits include:

1. Improved employer attractiveness and employee engagement

When it comes to choosing an employer, a company’s sustainability agenda is now a critical selection criterion – 92% of people would consider changing jobs if offered a role with a company that has an excellent corporate reputation. Moreover, corporate sustainability can strengthen employee engagement, which, in turn, can lead to higher productivity, increased innovation, lower attrition, and reduced hiring costs. One survey found that a strong employer brand can reduce the cost per hire by as much as 50%.

2. Decreased costs

A strong ESG program can contribute to decreased expenses across the board. Examples include lower costs in operations (energy, water, materials, waste, maintenance, insurance), HR (productivity, hiring), regulatory compliance, access to capital, etc.

3. Increased investor attractiveness

Investors are interested in companies that incorporate sustainability in their business strategies and work for a clear purpose – 73% say to win their support, companies must show how they are supporting communities and the environment.

4. Easier partner relationships

Businesses are increasingly using vendor ESG ratings/scores to find ethical and sustainable partners and suppliers. As a case in point, over 200 major companies representing US $5.5 trillion in procurement spend, requested ESG disclosures from 23,487 suppliers in 2021.

5. Greater regulatory agility

Between 2016 and 2020, the number of ESG reporting provisions issued by governmental bodies increased by 74%. Today there are more than 1,200 reporting requirements worldwide, of which nearly 80% are mandatory. Anticipating new regulations allows you to adapt ahead of time.

6. Stronger brand reputation, trust, and credibility

Every company is embarking on a transformation – from siloed compliance initiatives to trust intelligence – and ESG sustainability is a core part of that. Many brands that implemented sustainability at the core of their business model in the past now enjoy an exemplary reputation that grants them enduring customer trust and loyalty. Even more telling, trusted companies outperform the S&P 500 by 30 to 50 percent. Building businesses based on trust, rather than simply compliance, positions you to be a leader across ESG, privacy, risk, and ethics to drive growth and create impact.

7. Deeper customer loyalty

Now more than ever, customers expect products and services to be sustainable and not harmful to the environment or society. Businesses that do not meet their expectations lose opportunity and leave themselves at a competitive disadvantage.

The following resources can help you get started with building and communicating the business case for your ESG sustainability initiatives:

These toolkits can help you establish a successful ESG program that will serve as a central source of organizational growth, differentiation, and improvement for years to come.

5 Easy Steps to Jump Start Your ESG Program

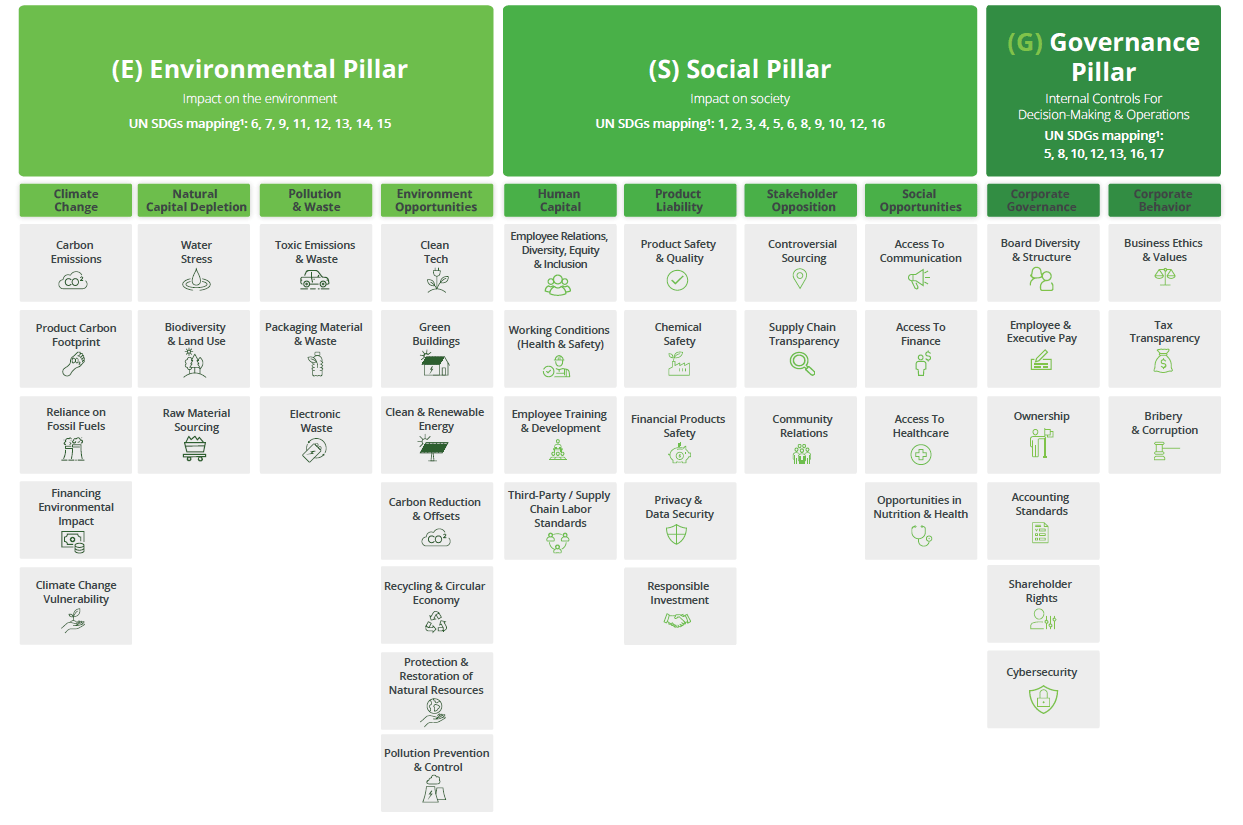

Having a strong ESG program can reduce risk and expand opportunities, directly impacting company performance and valuation. As you begin your ESG journey, set yourself up for success by identifying the right stakeholders and evaluating the high impact factors in your industry as well as those of your specific organization. Remember that these will be both internal and external, spanning your upstream and downstream supply chain. For practical guidance on how to get started, download the ESG Program Checklist.

Take 5 Simple Steps:

1. Define

Clarify the purpose, roles, and goals for your ESG program. These may be dynamic and subject to review and updating as circumstances dictate.

2. Prepare

Set up your ESG program and governance structure. Create your stakeholder map and gather preliminary data. Decide which reporting frameworks and standards you will use.

3. Assess and measure

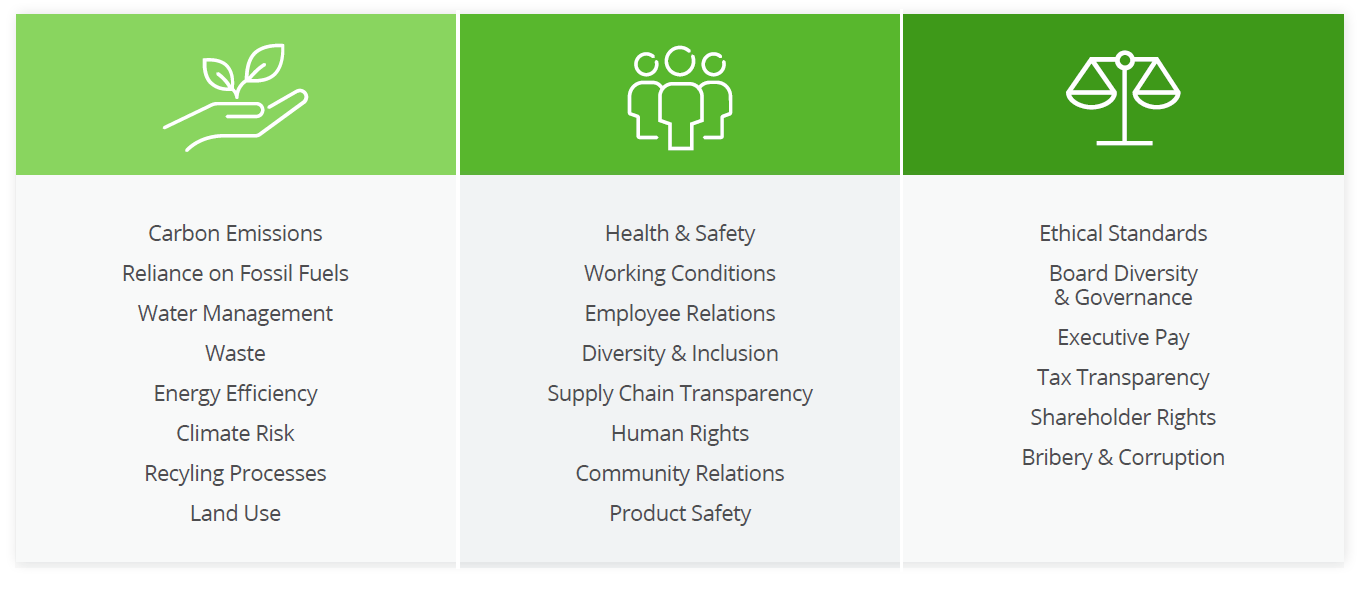

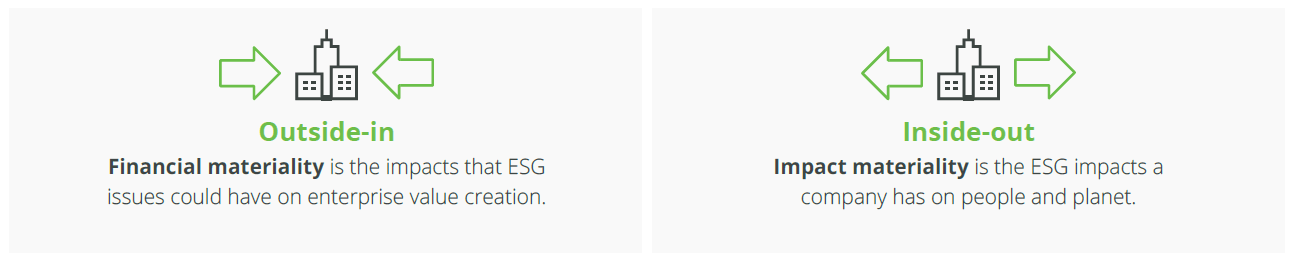

Define materiality by stakeholder. Select and prioritize the ESG issues most relevant to your industry and stakeholders. Consider double materiality (outside-in and inside-out) to determine material ESG metrics and topics. Collect the data needed to build your ESG report from surveys, application integrations, and data loads. Determine key ESG risks and opportunities.